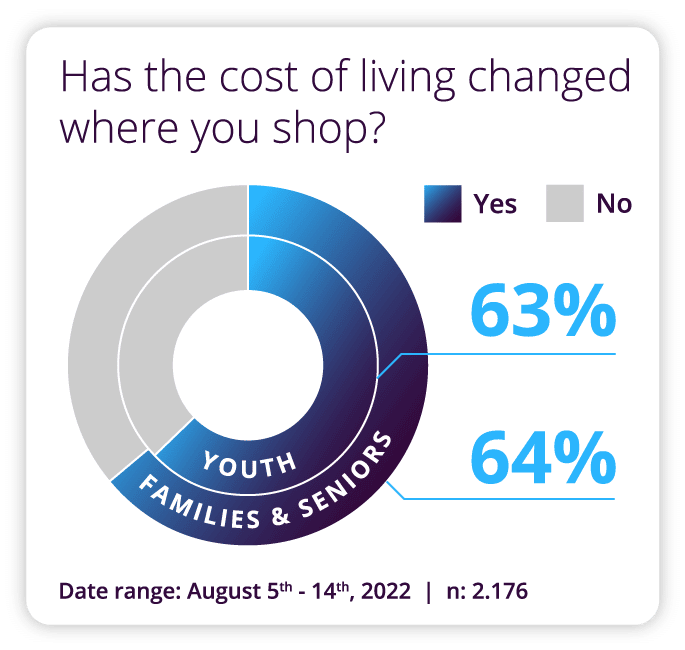

In Parts 1 and 2 of our Inflation Report, we looked at the cross-generational impacts of inflation and how global price rises on daily necessities are impacting consumer habits respectively.

In Part 3 of the report, we turn our eye to how inflation is leading to a new consumer mindset overhaul – one less inclined to discretionary purchases, yet at the same time more willing to potentially try new retail options.

While inflation no doubt requires careful management and a sense of adaptability, it is important to remember that a crisis can often be the catalyst to seize a new opportunity.

In this section of the report, we explore how retailers can turn a potentially difficult situation into an imperative to make necessary strategic adaptations to future-proof your business .

The Data:

The Story:

While location, stage of life, and of course, relative income all have an impact on consumer spending patterns – one overarching trend that can be seen across demographics is an increasingly thoughtful approach to consumption overall.

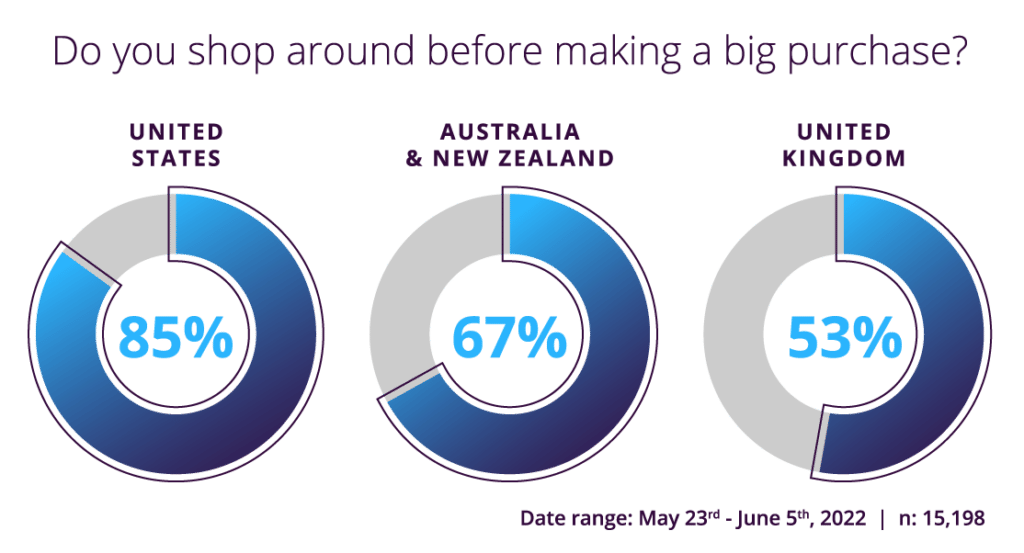

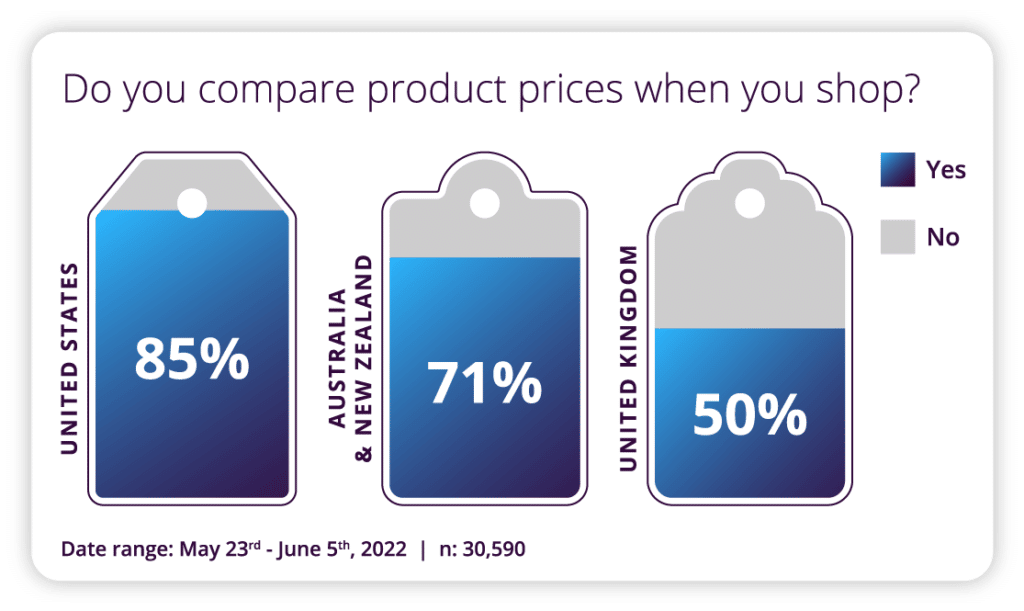

A tightening of the purse strings brings with it a natural inclination to be more cautious but also impacts our willingness to shop around (and to try new retailers), to search out a good deal, and to invest more time in finding the best bang for our buck.

The very concept of ‘value’ is undergoing a re-evaluation in the current climate:

Quality of goods and not just price point is increasingly the key driver for customers who no longer see discretionary or frivolous purchases as desirable or necessary.

Verticals including Home, Electronic, and Luxury overall, are also seeing a kick-back from the pandemic glut in spending on big ticket items (fueled by the catalyst of stimulus cheques) that helped many to get through lockdowns with a semblance of sanity. And yet in-spite of this, an analysis of our retail base shows that it is actually deep discount retailers who are now feeling the heat – as customers reign back on purchases seen as disposable or unnecessary.

While customers may be more cautious, the flip side is that you have an opportunity to win them away from the competition through clever marketing and comms.

In a difficult market, retailers need to talk much more about product quality, product benefits and unique selling points to convince customers to visit stores, make purchases and put an extra item in the basket.

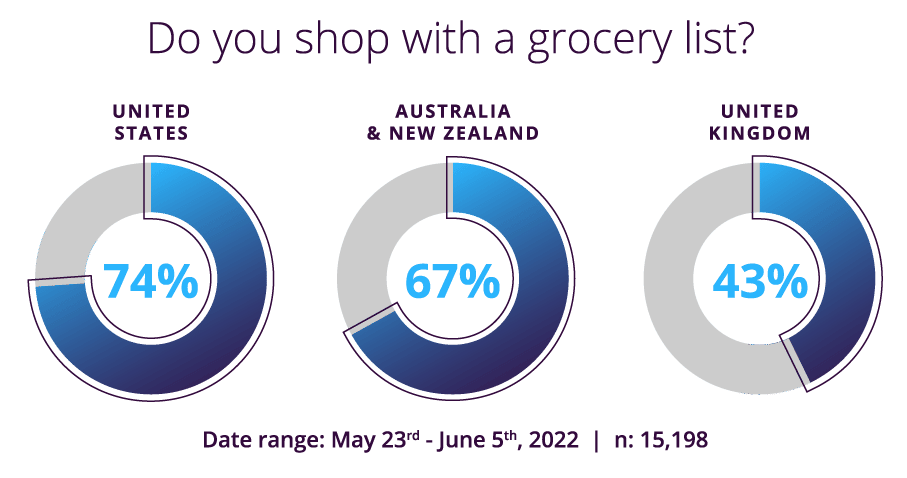

The rise in customers using a ‘list’ for shopping is another clear example of a loss on discretionary spend (customers who use a list have been shown to spend 15% less on average). While you can’t control whether customers use a list, you can control what’s on it – to ensure you capture the greater share of the ‘more thoughtful spend’.

Key Takeaways:

- Quality service and goods are more important than simply cheap deals to the thoughtful consumer

- Expect discretionary purchases to drop in the coming months – what can you do to make up for this?

- Don’t ask ‘How can I get them to do that?’ – do ask ‘what can I do to help them get what they need?

Retailer Tip:

At a time where consumers are more conscientious about where they shop, the value of staff in increasing perception of overall value and brand quality at a holistic level can not be overstated. While retail staff have sometimes been viewed as throwaway due to high turnover, understanding the impact of hiring and retaining good people for your brand is key.

- Do you treat your staff as brand ambassadors or simply as cashiers?

- Do you have any policies in place to help your staff as well as customers through difficult times right now?

- Are you aware of the increased value perception that knowledgeable staff can bring (+ resultant impact on increase in return visits & customer spend)?

Influencer View:

The consumer is always evolving, and the savviest of retailers should always be reacting to that. With inflation an increasing concern among consumers and influencer of overall spending trends currently taking place, it’s critical for merchants to make inflation a top priority. This includes their efforts in customer communication, store marketing, and of course, inventory management.

Nicole Leinbach, Founder & Publisher, Retail Minded, Co-Founder, Independent Retailer Conference