An increase in inflation has prompted shoppers to change their spending habits, especially in the retail sector. Joe Skorupa, retail consultant and Editor at Large for RIS News, an EnsembleIQ media portfolio, teamed up with TruRating’s Chief Data Officer Gareth Johns to discuss the changes in consumer behavior in times of inflation.

“I know times of high inflation are challenging for both retailers and consumers,” Skorupa said. “However, there are tools and techniques that can reduce the negative impact of high inflation…”

Gareth Johns highlights from a McKinsey study that 90% of consumers have noticed that prices are increasing. Since consumers are seeing this price shift, this inherently changes consumers’ behavior towards spending. Many variables have led to these changes in behavior, although a significant cause is the impact of COIVD-19 paired with a global pandemic. This alone has created reformed and cautious consumers.

“Not to say that everyone is suffering equally by any stretch of the imagination, but a much wider section of consumers have noticed the change in prices,” Johns said. “What will be interesting is to track what percentage of consumers now start to change their behaviors in ways that impact retailers.”

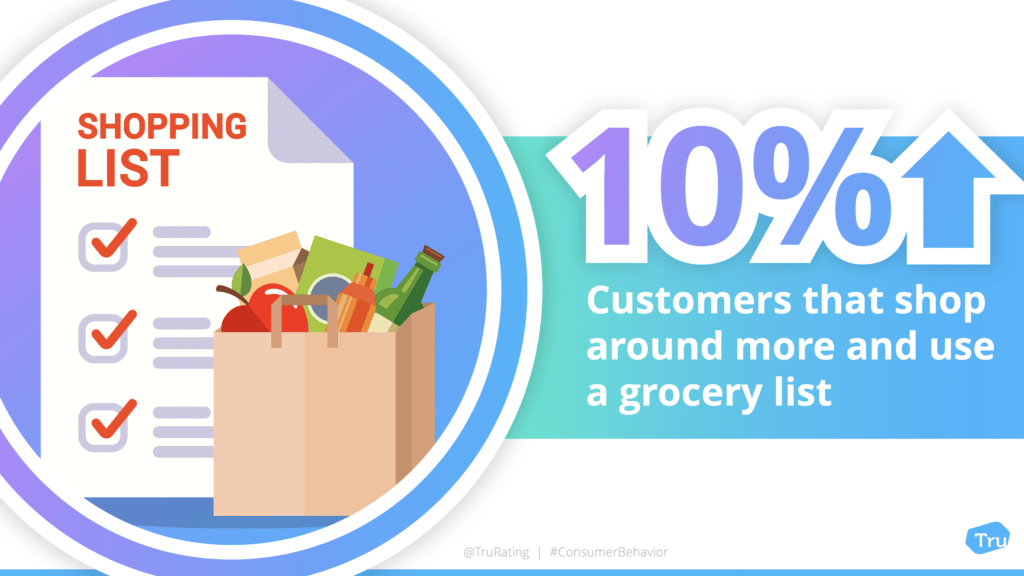

In June, TruRating gathered real-time data on inflation from thousands of consumers, and here’s what we found. There was a 10% increase in the number of shoppers who said they have started to shop around more before a big purchase and shoppers who have started shopping for groceries with a list. For many shoppers, this is already their reality. Whereas the number of shoppers that could spend more freely is shrinking.

How can retailers reduce the negative impact of high inflation?

- Focus on loyalty. Beware of rising churn among your best customers, so if your focus is on prices, keep those prices low; if it is on convenience, maintain your high levels. If it is on service, don’t let it drop due to higher wages or staffing challenges.

- Seek long-term advantages through short-term initiatives. Use targeted promotions to not only win price-sensitive shoppers but to target growing specific shopper groups. For example, if seasonal center-aisle items are a long-term goal for a grocer, then now is an excellent time to launch to capture the large group of shoppers trying new things. Don’t pull back on long-term gains as you roll out short-term responses to inflation.

- Value attributes other than price. Such as eco-friendliness, wellness, and social responsibility. Identifying with the shopper’s own values is a good way to earn respect, do something for the greater good, and build loyalty that adds value and goes far beyond price.

- Focus on in-house brands. Not only are in-house brands typically exclusive to a retailer, but they typically offer better profit margins (or at least more controllable profit margins) than national brands. This strategy can work across the board, from grocery to apparel to home improvement. For retailers without a strong in-house brand capability, this is an ideal environment to give it a boost.

Do you want more? Watch the entire webinar today: