Retailers often focus on immediate sales metrics, but long-term success hinges on understanding the full value a customer brings over time. Customer Lifetime Value (CLV) offers this insight, quantifying the total revenue a customer is expected to generate throughout their relationship with your brand.

For most businesses (including retailers), acquiring a new customer is significantly more expensive, costing up to five times more than retaining an existing one. This reality emphasises the importance of developing strategies that improve CLV, as they tend to be more profitable and cost-efficient. By concentrating on CLV, you can strategically allocate resources towards high-value customers, with the aim of fostering long-term connections and sustainable growth.

In this guide, we break down what CLV really means, why it’s important for retail success, and how you can increase it using actionable, data-driven insights.

What is customer lifetime value?

Customer Lifetime Value (CLV) refers to the total revenue a customer is expected to generate for your business over the entire course of their relationship with your brand.

It’s a clear, quantifiable way to understand the long-term impact of your customer relationships. Unlike short-term sales metrics, CLV reflects a full picture, including customer retention, repeat purchase rate, average order value, and overall purchase frequency.

If your CLV increases, your business becomes more efficient and sustainable. If it’s declining (or worse, unknown), you’re operating without visibility into your customer base’s financial value.

Why is customer lifetime value important?

CLV is not just another KPI but the foundation of every successful business strategy. Understanding CLV empowers you to make informed decisions that drive growth and foster long-term customer relationships. Here is why customer lifetime value is important:

- Understanding your CLV enables you to establish realistic customer acquisition cost (CAC) targets

- A higher CLV typically signifies improved customer loyalty, providing a more transparent return on retention marketing efforts

- When CLV surpasses CAC by a healthy margin, the journey to business profitability becomes considerably more predictable

- From customer segmentation to personalised marketing, CLV directs your resources towards high-value opportunities

- Grasping CLV simplifies the measurement of the true impact of your customer experience management efforts and delivering ROI

Simply put, CLV bridges the gap between customer relationships and financial performance, and that’s why retailers need to understand, measure and influence it.

How to calculate customer lifetime value

The most straightforward formula for CLV in a retail environment is:

CLV = (Average Order Value) x (Purchase Frequency) x (Customer Lifespan)

Each component plays a vital role:

- Average Order Value (AOV) shows what customers spend per transaction.

- Purchase Frequency tells you how often they buy within a set timeframe.

- Customer Lifespan indicates how long they stay engaged with your brand.

For more advanced analysis, you can incorporate net profit margins, CAC, or segment-specific behavior using cohort analysis and predictive analytics.

What is a good customer lifetime value?

The definition of a “good” CLV will vary depending on your business model. However, a common benchmark is:

- CLV should be at least 3x your CAC

This ratio ensures that your marketing and acquisition costs are generating long-term returns, not just short-term wins.

For example:

- A low-margin, high-volume retailer may thrive with a lower CLV.

- A high-end brand may require a significantly higher CLV to be viable.

No matter the model, improving CLV always strengthens the fundamentals of your business.

Can customer lifetime value be negative?

Yes! And that’s a serious issue. A negative CLV means that your average customer costs more to acquire and serve than they bring in through purchases. It’s a sign that your CAC is unsustainable, and your retention strategies are underperforming.

A negative CLV isn’t just a concerning metric but an important warning signal. It suggests that improvements are necessary to retain customers.

How to measure customer lifetime value

Measuring CLV involves more than analyzing figures. It’s about realizing the full potential of your customer base. To do it right, you need a blend of transactional data, behavioral insights, and meaningful feedback, all tied together with a clear view of the customer journey. Here are the foundational metrics that power a strong CLV model:

- Revenue per customer

- Average Order Value (AOV)

- Purchase frequency

- Customer behavior analysis

- Customer segmentation

But raw data alone isn’t enough. True CLV measurement requires context. Integrating customer feedback (especially at key moments of interaction) reveals the “why” behind the numbers. It helps uncover what’s driving spend, what’s killing loyalty, and where you’re leaving money on the table.

That said, traditional methods often fall short. Feedback collection is slow, response rates are low, and insights surface weeks (or even months!) after. By then, the customer’s already gone. That’s the problem. Now here’s how we solve it…

How TruRating measures customer lifetime value

At TruRating, we take a smarter, privacy-first approach to measuring CLV, rooted in real behavior, not assumptions. Thanks to our direct integrations with major payment providers, we receive a one-way encrypted hash of each customer’s payment card. It’s secure, anonymous, and allows us to identify repeat visits without ever needing to know who the customer is.

What that means in practice is that we can connect every piece of customer feedback to a real transaction, and then track how that same (anonymous) customer behaves over time.

Let’s put it into perspective…

In a recent analysis with a national grocery chain, we isolated feedback from customers who rated staff friendliness during a single visit. We subsequently tracked their return behaviour over the next 12 months. The results were staggering – customers who had a negative interaction with staff returned five times less often in the following year.

This isn’t abstract theory. It’s the business case for CLV, proven with real data. Rather than merely understanding customers’ immediate emotions, you can see how those emotions influence their spending behavior over time.

With TruRating, CLV becomes more than a retrospective metric. It becomes a real-time feedback loop, a way to identify which moments in the customer journey are driving (or draining) future revenue. Ultimately, you’re not just measuring value but learning how to influence it.

How to increase customer lifetime value

Increasing customer lifetime value is one of the most impactful ways retail teams can drive long-term growth, yet it’s often overlooked in favor of short-term wins. However, brands that prioritise customer retention and loyalty-building strategies consistently outperform those that don’t.

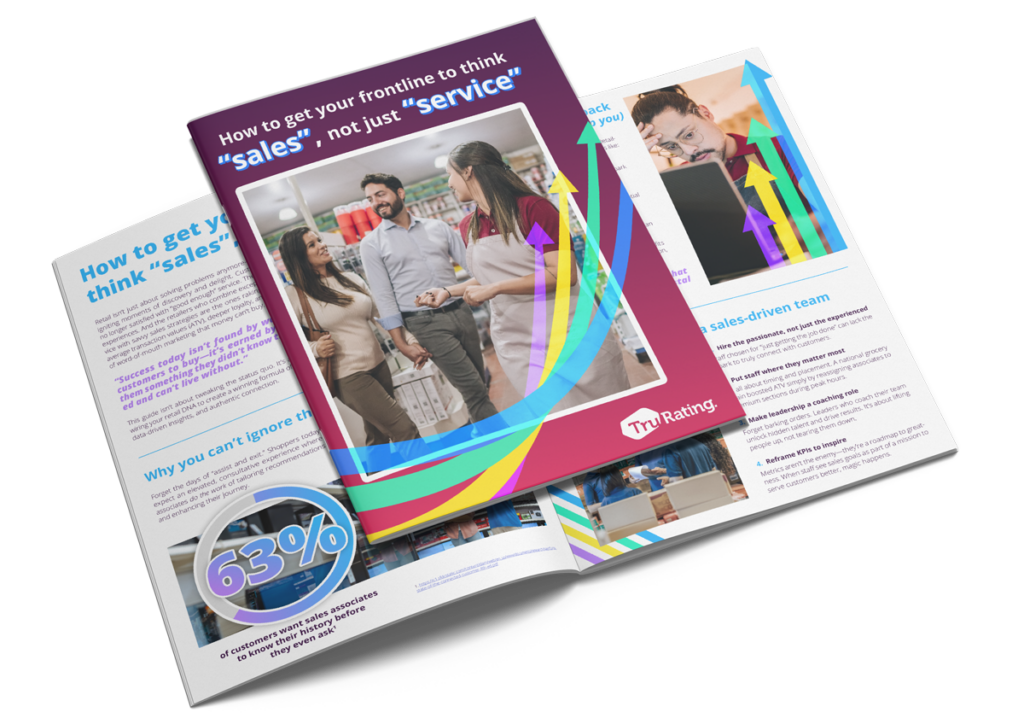

We’ve created a practical, insight-rich resource to help:

Download mastering customer loyalty – how to turn first-time shoppers into lifelong fans.

This exclusive guide offers proven strategies to help you build meaningful relationships with your customers, starting from the very first visit.

Here’s a quick preview of what’s inside:

Personalization is the loyalty superpower

Did you know that 60% of consumers are more likely to become repeat buyers after a personalized experience? The guide explains how to use purchase history, customer behavior data, and loyalty program engagement to deliver customized interactions that feel personal and relevant, online and in-store.

The hidden driver – your frontline staff

Nearly 60% of shoppers say that friendly service is the number one reason they return to a store. The guide reveals why training staff for empathy, authenticity, and helpfulness is one of the highest-ROI investments you can make to reduce churn and increase spend.

Rethinking loyalty program

Forget blanket discounts. The best loyalty programs today reward engagement, emotional connection, and brand advocacy. The guide explores ways to personalize rewards, build community, and design experiences that make customers feel valued.

How to predict customer lifetime value

Predictive CLV models use machine learning and historical data to forecast future customer behavior. They allow you to:

- Identify high-potential customers early

- Allocate marketing resources more efficiently

- Reduce churn through proactive engagement

Key inputs include:

- Purchase history

- Interaction frequency

- Channel preferences

- Loyalty scores

- Product affinity and browsing patterns

When executed correctly, predictive analytics helps you make smarter, faster decisions that directly increase lifetime customer spend. Learn more about predictive analytics in retail.

How feedback surveys increase customer lifetime value

Here’s the truth: when it’s done right, customer feedback is one of the most powerful tools for increasing CLV. Outdated methods like post-purchase email surveys or quarterly promoter reports don’t cut it anymore. They’re slow, generic, and rarely lead to action.

Modern feedback needs to be real-time, contextual, and actionable. Our approach is real feedback, real results. The TruRating eco-system has been built to help retail operations leaders drive measurable improvements in CLV by capturing real-time feedback right at the point of transaction.

Here’s how it works:

- Collect verified insights from over 80% of customers using a single rotating question at checkout

- Connect every piece of feedback to transaction-level data like basket size and time of day

- Empower your teams with AI-powered dashboards tailored to their roles

- Use our analytics platform (or yours) to uncover actionable insights and identify high-impact improvements

This way, you’re not just collecting feedback. You’re tying it directly to revenue. Every insight can be translated into action that improves retention, increases average spend and strengthens brand loyalty.

And because we integrate with major payment providers, you can be live in days, not months. No lengthy implementation, no overcomplication, just results.

Looking to improve your customer feedback strategy? Learn more about our customer feedback platform or schedule a demo today.