For too long, retail has been obsessed with fluffy CX metrics, chasing promoter and CSAT like they’re the finish line. Ask any high-performance retail ops leader and they’ll tell you:

“What are customer experience performance metrics?” They’re whatever helps us sell more, retain more, and grow more. In other words, CX metrics should be business metrics.

According to the 2025 Connectivity Benchmark Report (MuleSoft x Deloitte), 90% of organizations say data silos are a direct challenge to growth. Even in an era of generative AI and autonomous agents, teams struggle to connect their data, integrate their systems, and, most critically, tie customer insights to business results.

In retail, this fragmentation is deadly. Too many CX metrics are stuck in isolated dashboards, disconnected from the business KPIs that matter: average transaction value (ATV), conversion, retention rate, and revenue growth. If your CX measurement isn’t operational, integrated, and focused on outcomes, it’s just another silo holding you back.

The future of customer experience measurement is pure business: CX KPIs = revenue KPIs. The retailers winning today are those who reframe every feedback signal as a lever to move spend, loyalty, and growth.

If your customer experience tracking doesn’t deliver measurable impact on revenue, it’s just noise. This is the wake-up call for every retail CX and operations team: reframe your CX KPIs to mirror the metrics your CFO cares about.

What are customer experience performance metrics?

Let’s set the record straight. Customer experience metrics aren’t about making you feel good. They’re about giving you actionable signals that change the way you run your business. Traditional “customer experience measurement” has created feedback paralysis:

- Too many dashboards, not enough direction

- Too much sentiment, not enough signal

- Scores that rarely move the revenue needle

It’s time for a retail reality check: CX KPIs should be the same metrics you use to judge store performance and frontline staff, the ones tied to conversion, spend, and retention. In other words: CX measurement = business measurement.

How to measure customer experience

Measuring customer experience should feel more like running a P&L than running a focus group. Here’s how retail leaders are reframing CX:

- Every feedback point links to a business outcome.

- Not “Did they like it?” but “Did they spend more? Come back? Buy again?”

- CX KPIs become business KPIs.

- ATV, conversion rate, retention rate, basket size, lifetime value, they’re your true customer experience management KPIs.

Metrics drive behavior, not reports. The only metric to prove CX is one that empowers managers to act and teams to win, today, not next month. Stop asking ‘How satisfied are you?’ Start asking:

- Did we convert more customers today?

- Did our average basket value go up after we fixed that pain point?

- Are customers coming back, and spending more?

The retail action loop, from CX metrics to business outcome

Here’s the action plan for retail leaders:

- Ask at the point of purchase

- Stop with the endless post-purchase survey data that never gets read. Instead, collect high-response, in-the-moment feedback (TruRating gets 80%+ response rates).

- Link every metric to transaction data

- Connect customer experience measurement tools directly to ATV, UPT, loyalty, and conversion.

- Drive store-level action

- Push insights to every frontline manager, not just HQ. Let them own the outcome.

That’s how customer experience management becomes a revenue-driving engine, not just a CX metric reporting headache.

The CX metrics that actually drive retail outcomes

1. Average Transaction Value (ATV)

Direct tie: Revenue, upsell success

Why it matters: If your customer experience efforts aren’t increasing the value of each basket, you’re leaving money on the table.

How to measure (ask in-store):

- “Did our staff recommend additional items during your visit?”

- “Was it easy to find complementary products?”

- “Did anything make you spend more or less today?”

How to act on insights:

- Coach staff on suggestive selling. If customers aren’t offered add-ons, introduce daily staff challenges with incentives.

- Merchandise for add-ons. Reorganize displays so best-selling items are paired with relevant accessories.

- Spotlight winning teams. Share results store-to-store to boost healthy competition and lift ATV chain-wide.

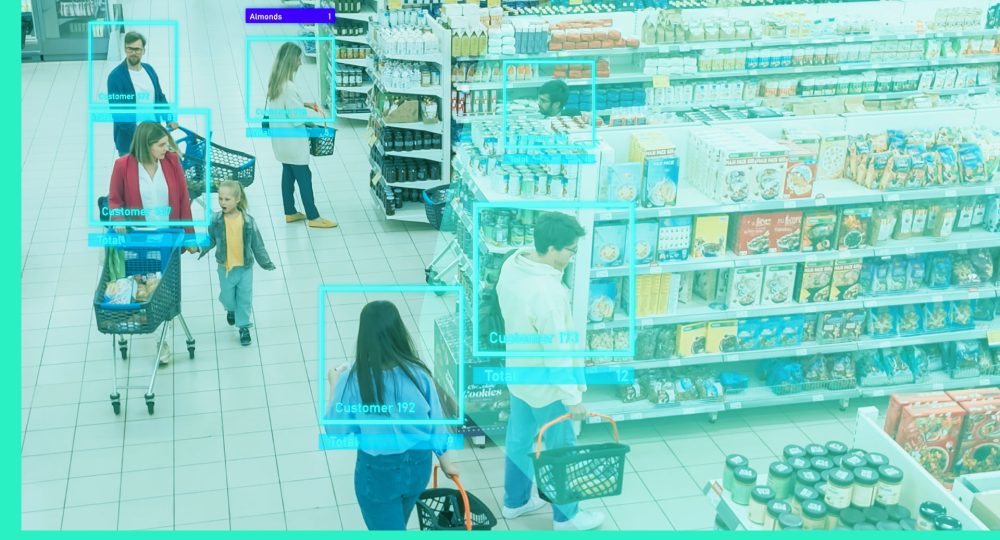

2. Conversion rate

Direct tie: Sales growth, marketing ROI

Why it matters: The ultimate proof that you are minimising friction and delivering value is an increasing number of browsers turning into buyers.

How measure (ask in-store):

- “Did you find everything you came in for?”

- “Was there anything that stopped you from making a purchase today?”

- “How easy was the checkout process?”

How to act on insights:

- Fix friction points immediately. If out-of-stocks or confusing layouts are a problem, brief teams daily on replenishment or layout tweaks.

- Share customer language. Use feedback in morning huddles to get staff thinking from the customer’s perspective.

- Streamline checkout. If customers mention long waits, deploy more staff or promote mobile POS during peak times.

3. Customer retention rate

Direct tie: Lifetime value, churn reduction

Why it matters: Repeat business is the foundation of retail growth. True loyalty shows up in return visits and longer customer relationships.

How measure (ask in-store):

- “Have you shopped with us before?”

- “What makes you return to our store?”

- “What could we do to encourage you to come back?”

How to act on insights:

- Spot patterns in annoyance. If customers flag recurring annoyances (e.g., staff turnover, inconsistent greetings), address them directly with the relevant teams.

- Target retention campaigns. Use feedback data to create localized offers that bring customers back.

- Leverage TruTrace technology. Use TruRating’s TruTrace to anonymously track repeat visits without invading customer privacy. By monitoring changes in feedback from repeat visitors, you will see directly how frontline improvements affect loyalty and satisfaction.

4. Basket size / units per transaction (UPT)

Direct tie: Incremental sales, operational efficiency

Why it matters: Customers who feel supported and inspired buy more; it’s as simple as that.

How measure (ask in-store):

- “Did you buy more items than you planned?”

- “Were staff helpful in suggesting additional products?”

- “Did you feel you had enough choice in the store?”

How to act on insights:

- Train staff on cross-selling. Run roleplays or micro-trainings focused on uncovering customer needs.

- Spot missed sales opportunities. Use feedback about missing products or lack of inspiration to update displays or retrain staff on product knowledge.

- React to annoyances. If shoppers mention “not enough variety,” review assortment and adjust orders or display.

5. Repeat purchase rate / share of basket

Direct tie: Loyalty, brand preference

Why it matters: Loyalty isn’t about points, it’s about whether customers choose you again and again over competitors.

How measure (ask in-store):

- “Have you visited us in the last month?”

- “Did a previous positive experience influence your return today?”

- “Would you recommend us to friends or family?”

How to act on insights:

- Respond to loyalty killers. If feedback reveals annoyances that would stop someone from returning, flag and fix them for future visits.

- Celebrate champions. When feedback can highlight staff who made a difference, recognize and share those wins.

- Double down on what works. If positive stories emerge, turn them into best practice examples for other stores.

6. Basket abandonment rate

Direct tie: Digital experience, lost revenue

Why it matters: Every abandoned basket is a CX problem and a missed sale.

How to measure (ask in-store):

- “Was the queue wait time long today?”

- “Did you have any issues finding products?”

- “What could have made your shopping experience easier?”

How to act on insight:

- Connect feedback to SKUs. Link qualitative TruRating feedback directly to the SKUs in each shopper’s basket. This allows you to identify which products resonate most with your loyal, returning customers.

- Discover loyal market segments: Analyze repeat purchase data and feedback to uncover patterns, such as specific products, categories, or offers favored by your most frequent shoppers.

- Remove friction fast. Do not wait weeks for more data, take action on what you are observing in real-time and resolve issues promptly.

How retailers are winning with revenue-driven CX metrics

Retailers using TruRating to reframe their customer experience management metrics are seeing real-world results:

- Action, not dashboards. Store teams see insights in real time. One TruRating retailer leveraged our insights to achieve a 5% year-on-year sales increase by acting on feedback that influenced ATV and conversion, rather than solely on sentiment scores.

- Behavior change at scale. One global retailer we work with discovered that greeting customers and offering add-ons lifted ATV by $10 per transaction, because TruRating made the revenue impact of each behaviour visible, store by store.

That’s the power of reframing CX KPIs. Retailers who lead don’t wait for lagging indicators or feel-good dashboards, they make customer experience KPIs the foundation of business growth.

If you’re ready to stop guessing and start winning, TruRating connects customer insight to business outcome, at every level, every day.

Ready to put revenue at the heart of your CX strategy? Learn more about our retail analytics software or talk to our team to see how performance-led feedback is transforming retail.