Across every earnings call I’ve analyzed, every boardroom I’ve presented in, and every frontline operations meeting I’ve led—one theme keeps surfacing: the strategy wasn’t wrong. The problem was in how (or whether) it was executed. Most retailers don’t have a strategy gap. They have a system gap.

A system that tells them, in real time:

- What’s working and what’s not, store by store

- Whether their customer-facing initiatives are landing the way they were designed

- Where invisible breakdowns are eroding ATV, conversion, and repeat rate—before those signals show up in POS data

Instead, most operators are forced to make multimillion-dollar rollout decisions based on anecdotes, lagging reports, or pilot results that don’t scale. And when the results fall flat, the blame gets passed around:

- CX says it was an ops issue.

- Ops says the format was flawed.

- Strategy says it lacked adoption.

- Field leaders say, “We told you the staffing model didn’t work.”

This is the execution problem. And it’s costing retail billions every year in missed opportunity. But let’s be clear: this isn’t a performance coaching issue. It’s not a training issue. It’s not even a “data” issue.

It’s a system design issue.

Most retailers are running 2025 strategies on 2005 infrastructure. They’ve got loyalty programs without execution feedback. Service standards without real-time validation. Store pilots without behavior-level signal. CX programs built on surveys that can’t tell you which shift, in which store, on which day broke the experience. And because they don’t have this visibility, they operate reactively:

- They fix problems after the customer is already lost.

- They coach after the comp performance is already off.

- They re-engineer strategies after brand trust has already been damaged.

This is not sustainable. The reality is: you can’t manage what you can’t see. And you can’t scale what you can’t validate. Which brings us here. After two decades leading both field operations and customer experience at scale, advising some of the world’s largest retail brands, I’ve come to one conclusion:

Retail doesn’t need another feedback tool. It needs a new system layer. One that’s built not for insight, but for execution. That layer is what we call the retail performance layer.

It’s not a dashboard. It’s not a survey. It’s not a quarterly review cycle. It’s a system embedded inside the business, underneath the strategy, that enables every customer-facing initiative to be validated, corrected, and optimized in real time.

In this blog series, I’m going to walk you through what that layer looks like. How it works. What the most successful retailers are already doing. And what happens when you don’t build it.

Because if you’re still operating on dashboards and surveys, you’re already behind. The retail performance layer is what comes next. Let’s define it, build it, and use it to fix the broken loop between what you planned and what actually happened.

Legacy tools were built for reporting, not for performance

The tools most retailers rely on today were never designed to drive performance. They were designed to report on it. That’s a critical distinction.

They capture sentiment. They visualize trends. They tell compelling stories about what customers felt. But they do not, and cannot, tell you whether your frontline teams are consistently delivering the experiences those strategies were built to create.

Let’s break that down.

1. Voice of Customer (VoC) tools: built for aggregation, not action

Traditional Experience Management VoC Platforms were revolutionary when they hit the market. They offered a centralized way to collect and analyze customer feedback. And for years, they’ve been the gold standard in what we called “experience management.”

But what most retailers have learned the hard way is this: VoC is excellent for analyzing what customers say after the fact, but nearly useless in helping teams’ course-correct in the moment of friction.

It’s built on surveys that customers complete hours or days after the interaction, often in channels disconnected from the original experience. Worse, the data is presented in aggregate – brand-level NPS, category-level CSAT, or correlation scores that require deep analytics teams to translate into action. By the time insights are surfaced, the opportunity to influence behavior has passed.

VoC doesn’t answer:

- Did the new checkout model drive conversion lift in the bottom 20% of stores?

- Did the store teams actually offer three product options, as trained?

- Did shift managers deliver the new service standard with consistency?

That’s not a knock on VoC. It’s just not what it was built for.

2. Mystery shopping: episodic theater in a real-time world

Mystery shops are another legacy tool that, frankly, has no place in a high-performance retail environment today. They’re episodic. They’re subject to manipulation. They reflect what one person experienced on one visit – not a scalable, accurate read of store execution. I’ve personally watched store teams prepare for mystery shop windows like they were final exams: cleaning, coaching, rehearsing behavior that disappears the moment the audit ends.

What does that tell you about your customers’ everyday experiences? Absolutely nothing. More importantly, it doesn’t help field leaders coach in real time. It doesn’t show shift-level patterns. It doesn’t reveal whether the new behavior model is being executed differently in Store 211 vs. Store 308.

At best, mystery shopping is reputation theater. At worst, it’s a compliance relic masking as insight.

3. POS and sales data: powerful on “what,” blind on “why”

Many retail leaders lean on POS and CRM data to drive operational decision-making. And it’s true: no one should run blind to sales trends, ATV, UPT, or repeat purchase behavior. But here’s the trap: POS tells you what sold, not what broke the sale.

It shows you revenue drops, but not whether that drop was caused by poor associate engagement, inconsistent service behavior, lack of fitting room support, or simply a friction-filled layout. Without signal at the point of interaction, you’re left guessing.

Even when brands try to layer POS trends with VoC data, there’s a lag both in time and in granularity. You can’t coach tomorrow’s shift based on last month’s reports. That’s why even best-in-class retail operations teams often operate reactively, not proactively. They’re chasing lagging indicators, not leading ones. And that delay is where performance erodes.

The common thread: these tools weren’t designed for the front line

Ask yourself this: Which system in your tech stack was built specifically for the store team? Not the customer insights team. Not brand marketing. Not IT.

I mean the Regional Manager walking into a location trying to figure out what’s working. The store manager trying to coach up the new assistant. The CX leader trying to validate whether the new service model is being executed across all 300 stores.

That person doesn’t need a dashboard. They need a signal loop. They don’t need a survey readout. They need performance feedback. They don’t need to manage experience. They need to drive it. And that’s what the existing stack can’t do.

We’ve spent the last decade building beautiful dashboards while our field leaders are still guessing at what broke the customer experience. This is where the retail performance layer steps in, not to replace VoC or POS, but to bridge the execution gap they were never designed to close.

It’s not a reporting tool. It’s a live, operational system for validating whether your strategy is landing where it matters most: on the floor, with the associate, at the moment of truth.

In the next section, I’ll define exactly what the retail performance layer is and how it rewires the retail operating model around execution, not explanation.

What retail actually needs: introducing the Retail Performance Layer

Let’s name the thing that’s been missing. Retail doesn’t need another signal. It needs a system. One that was purpose-built to operate at the intersection of strategy and execution. Not for post-hoc analysis. Not for quarterly readouts. But real-time operational feedback, tied to behaviors that drive revenue.

That system is what we call The Retail Performance Layer.

This isn’t a metaphor. It’s a literal, architectural layer in your business designed to sit underneath your existing customer experience, sales, and operational infrastructure. It’s the connective tissue between what your teams plan and what your customers experience.

Let me explain why this matters.

Strategy without execution is just theater

The modern retail enterprise is loaded with strategy:

- Store format innovation

- Associate training programs

- New checkout models

- Experience-led brand redesigns

- Loyalty overhauls

- Conversion optimization playbooks

Each one is carefully developed. Some are tested in pilots. A few even show promising early results. But then, execution gets lost in the rollout.

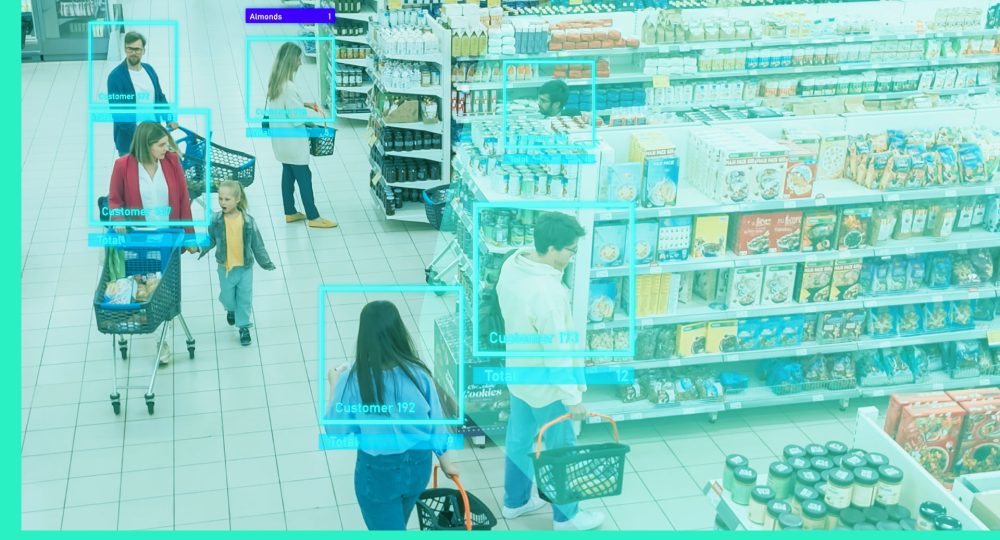

Not because teams don’t care. Not because frontline leaders are resistant. But because you can’t scale what you can’t see. And retail, for the most part, can’t be seen.

- Can’t see which stores actually adopted the new format

- Can’t see which shifts delivered the trained behaviors

- Can’t see where friction was introduced, and by whom.

- Can’t see which daypart is underperforming until sales are already down

Without that visibility, you don’t have a system, you have strategy theater. The retail performance layer solves this by operationalizing the feedback loop between customer behavior, associate execution, and business impact.

From strategy to signal to store execution

Let’s define what the retail performance layer does in concrete terms.

The retail performance layer is:

- A real-time, transaction-embedded feedback loop that captures both customer sentiment and associate behavior at the point of experience.

- A system that validates rollout success, not at the enterprise level, but store-by-store, shift-by-shift, even daypart-by-daypart.

- A coaching enablement engine that helps regional leaders, district managers, and store teams see the performance levers that matter most.

- A performance validation layer that ties execution to financial outcomes like ATV, conversion, and repeat visits.

This isn’t about replacing your tech stack. This is about activating it. Your CRM, POS, and CX tools are critical, but they don’t close the loop between friction and revenue loss. The retail performance layer does.

The stack: where this layer lives

Here’s how your operating system should look:

Why this matters:

All those tools above capture signals. But none of them validate execution. None of them connect what should be happening to what actually is happening. That’s the void the retail performance layer fills.

Without it, you’re operating on assumptions

If you don’t have a retail performance layer, you are:

- Relying on anecdotal store visits to understand why performance is dipping

- Waiting weeks to see if your pilot worked by watching NPS or sales trendlines

- Spending marketing dollars without knowing if the brand experience was delivered in-store

- Deploying new training and hoping it sticks without validating associate execution

- Making strategy adjustments with no behavioral evidence to back the change

That’s not performance management. That’s guesswork at scale. You wouldn’t run a contact center without real-time performance metrics. Why would you run 300 stores that way?

What it enables

With a retail performance layer in place, your business finally gets what it’s been missing:

- Real-time visibility into execution breakdowns

- Shift-level coaching signal linked to financial outcomes

- Validated store-level ROI on every major initiative

- Behavior-based feedback tied directly to conversion and ATV

- Friction detection at the point of decision, not in a post-purchase survey

You’re no longer managing experience in hindsight. You’re performing it in real time.

And that’s the shift retail has been waiting for.

Up next: I’ll show you the cost of not having this layer, how revenue quietly leaks through behavior breakdowns, failed pilots, and silent churn. Because once you see the gap, you’ll never run a rollout the same way again.