Walk into any retail headquarters, and you’ll find a familiar scene: a wall of promoter score dashboards, a folder of mystery shop reports, and a group of field leaders preparing to cascade feedback down the chain. It looks like performance management. It sounds like accountability. But what’s really happening is compliance theater.

Retailers have spent decades building systems to simulate control and tools that promise visibility into what’s happening on the floor. But dig beneath the surface, and most of these tools are not measuring execution. They’re measuring impressions, proxies, or perceptions.

And that distinction matters. Because you don’t drive revenue or retention with impressions. You drive it with behavior; repeated, consistent, high-impact behavior, across every shift. That’s what legacy tools like mystery shopping and NPS get wrong.

They offer the illusion of insight, but fail to capture what matters most: Is the frontline actually delivering the experience we trained and intended?

The dangerous assumption

When strategy leaders ask, “How are stores performing?” They’re not just asking for a number. They’re asking for confidence; the kind that says:

- Yes, our new service model is being adopted.

- Yes, our pricing conversation is being delivered at checkout.

- Yes, our loyalty program is being explained in every qualifying transaction.

But if your tools only show you:

- One person’s mystery shop score from two weeks ago

- An promoter score average that lags by days or weeks

- A quarterly trendline with no shift-level granularity

Then you’re not measuring performance. You’re guessing. And the cost of that guesswork compounds fast.

Why this blog exists

This isn’t a theoretical critique. It’s a frontline reckoning. I’ve sat in the seat of the field leader trying to coach a store with stale shop data. I’ve led CX teams that fought for months to explain why rising NPS didn’t translate to sales. I’ve run pilots that “looked good” on paper only to discover the core behaviors were never executed beyond the pilot zone.

And I’ve seen the price organizations pay when the feedback loop is broken:

- Good stores mislabeled as poor performers

- Bad habits rewarded because they slip under the radar

- Strategic initiatives delayed, derailed, or discarded without ever getting a fair shot

This blog is for every operator, strategist, and CX leader who knows there’s something broken and is ready to see the system for what it is. In the next section, we’ll dissect the first legacy tool in this system: Mystery Shopping, retail’s most expensive illusion of truth.

Mystery shopping – retail’s favorite illusion

For years, mystery shopping has worn the mask of operational truth. To the board, it looked like rigor. To operations, it looked like accountability. To store teams, it looked like surveillance. But to those of us who’ve lived on the frontline, It’s always been a performance for an audience of one.

One visit ≠ performance

The fundamental flaw in mystery shopping is this: it captures a moment, not a pattern. You get a single visit, from a single person, who may or may not follow the script, may or may not represent your real customers, and almost certainly won’t experience your business the same way your average customer does.

And yet, this one data point often gets treated as gospel, affecting:

- Store rankings

- Field coaching focus

- Bonus payouts

- Brand reputation

Think about that: Entire performance conversations shaped by one visit every 30–90 days.

It’s rehearsed, not real

Let’s be honest, every operator knows when shop season is live. And whether you say it out loud or not, your teams do too. Associates start overcompensating. Managers post reminders in the break room. Entire shifts become hyper-alert, bending behavior to the possibility of a test.

What you get isn’t a view into real experience. You get a dress rehearsal with the audience hidden in plain sight. “Mystery shopping doesn’t show you how the store actually runs. It shows you how the store wishes it ran.” This is theater, not truth. And worse, it teaches teams to perform for the score, not the customer.

The performance penalty

What happens when your field coaching is built on this illusion?

- Stores game the system instead of improving behavior

- High-performing locations with real consistency get overlooked because they “missed” one shop

- Underperforming stores stay hidden because they lucked into a compliant moment

- Field leaders waste time chasing false positives and punishing false negatives

Mystery shops rarely expose the root cause of friction. They capture symptoms without diagnosing execution. And that’s dangerous. Because if you can’t see the behavior breakdown, you can’t fix it.

Expensive noise, not scalable signal

Let’s talk ROI. Mystery shops are expensive not just financially, but operationally:

- External vendors

- Manual data aggregation

- Coaching bandwidth spent deciphering narrative comments

- Performance decisions made with incomplete data

And despite all that cost, mystery shopping can’t tell you:

- If a new initiative is being adopted

- Whether a team is struggling in the afternoon vs. morning

- How one associate’s behavior is impacting the overall experience

- What’s happening across every customer interaction

It’s not scalable. It’s not sustainable. And it’s not the truth.

The systemic consequence

The longer we treat mystery shopping as performance data, the more we distort our field enablement:

- Coaching becomes reactive

- Trust in the data erodes

- Top-performing stores disengage

- Strategic initiatives stall because HQ has no way to confirm real adoption

It becomes a loop of disconnection. Store teams stop trusting the tools. Field leaders stop trusting the results. HQ starts second-guessing both.

“You’re not running a performance system; you’re running a compliance puppet show.”

In the next section, we’ll turn the lens to NPS. Another well-intentioned tool that’s been misapplied as a performance system, rather than the sentiment signal it was designed to be.

Promoter scores – a signal, but not a system

Let me be clear upfront: I’m not anti-promoter scores. I’ve used them. I’ve led programs that optimized them.

And I’ve seen their power when used as a signal. But somewhere along the way, promoter scores became something it was never meant to be: A proxy for performance. That’s the problem. Because when you treat promoter scores like a management system instead of a directional signal, you don’t just misuse it; you weaponize it.

And that breaks trust. Internally and externally.

What promoter scores were designed to do

The original intent behind promoter scores was simple: “Let’s create a fast, consistent way to understand whether a customer would recommend your brand and why.” As a trendline, it works. As a strategic lens into brand love or brand decay, it works. As one of several voice-of-customer indicators? It works. What it was never meant to be:

- A frontline accountability metric

- A store-by-store performance comparison tool

- A direct measure of execution behavior

- A real-time feedback loop for coaching

But retail adopted it that way. Why? Because promoter scores are clean. They’re easy to benchmark. And it looks good in board decks. The problem is it doesn’t show you what happened in the interaction. It just shows how someone felt after it. And those are two very different things.

Promoter scores without behavior context is a red herring

Let’s say your promoter score drops by 10 points this week. Ask yourself:

- Was it due to wait time at checkout?

- Was it a rude associate?

- Was it product availability?

- Was it a poorly explained return policy?

- Was it weather, inventory, or staffing?

You don’t know. Because NPS captures outcome sentiment, not input behavior. It’s the emotional smoke without any visibility into where the fire started. “A customer may give you a 3. But unless you know what happened in the interaction, you’re coaching with a blindfold.”

The gaps it leaves behind

When brands over-index on promoter scores as the measure of customer experience, three things happen:

- Sentiment gets mistaken for execution

- Teams assume “good score = good behavior,” when that’s not always true

- Poor behavior that doesn’t trigger a complaint still goes unaddressed

- Field coaching gets diluted

- Managers spend time deciphering open text, not fixing observable behaviors

- Shift-level breakdowns go undetected

- Stores learn to chase scores, not outcomes

- Associates cherry-pick who gets asked

- Score-begging and survey-gaming creep into the culture

This isn’t feedback. It’s optics. And in the absence of deeper signal, HQ builds strategy on vibes hoping that a 65 NPS means “we’re doing great” across the board. It doesn’t.

The CX fallacy: “high promoter score = high performance”

Here’s the uncomfortable truth most retail leaders don’t say out loud: You can have high NPS and still lose customers. You can have high NPS and still have massive execution gaps. You can have high NPS and still be underperforming because you’re listening to the wrong signal or listening too late.

Promoter scores are directional. But direction without visibility is still a gamble. It’s not enough to know how the customer felt. You need to know why they felt it and whether your teams did what they were trained to do.

That’s not a role promoter scores can play. But it is the role of real-time behavior signal which we’ll unpack next. In the next section, we’ll shift gears and explore what modern retail operators are doing differently:

Installing real-time behavioral signal at scale to replace the guesswork.

Coaching in the dark – the field leader’s dilemma

Let’s talk about the people caught in the middle of this broken system: Field leaders. These are the district managers, regional directors, and multi-unit operators responsible for translating brand standards into daily execution across dozens, sometimes hundreds, of stores.

They are the linchpins of retail performance. And we’ve systematically under-equipped them.

The coaching gap: no signal, all pressure

Imagine being held accountable for performance, but not given access to real-time signal on what’s actually happening in your stores.

That’s the reality for most field leaders today.

- You get a weekly NPS snapshot with no behavior context.

- You get a mystery shop once a quarter, if you’re lucky.

- You get anecdotal feedback from stores, filtered by urgency and perception.

- You get POS data that shows the outcome, but not the inputs.

So what do you do? You rely on instinct. You make assumptions. You pick a coaching focus and hope it’s the right one. That’s not a strategy. That’s survival. “We’ve put performance responsibility on the field, but stripped away the visibility required to lead it.”

The operational cost of flying blind

Let’s break down what happens when field coaching becomes guesswork:

1. Misdirected Support

You spend time coaching the wrong behaviors in the wrong stores. You praise stores with “good” NPS but weak fundamentals. You penalize stores with “bad” shops that were flukes.

2. Coaching Fatigue

Store managers disengage. Why? Because they’re being asked to improve scores they can’t see, control, or understand. They hear “get your numbers up,” but never “here’s what’s missing from the customer experience.”

3. Inconsistent Standards

Without behavior signal, every district coaches differently. The brand experience fragments across locations, shifts, and leaders. What “good” looks like becomes subjective.

4. Lost Momentum

Great strategies stall out because adoption can’t be tracked in real time. Initiatives with huge upside fail not because they were bad ideas, but because execution couldn’t be verified or course-corrected.

Coaching Without Signal Is Just Noise

Let me be brutally honest: If you can’t see what your teams are doing on the floor, you’re not coaching. You’re narrating outcomes. And that doesn’t change behavior. It just creates confusion, fatigue, and resentment. Field leaders want to coach. They want to develop their teams. But you cannot coach behavior you can’t observe.

“We say we want consistency, but we’ve built a system where no one can see the playbook being run in real time.”

That’s the pain behind the dashboards no one wants to admit. And it’s why the most forward-thinking retailers are shifting from lagging feedback to live execution signal because the difference between activity and impact is visibility.

In the next section, we’ll show you what this modern system looks like in action and how TruRating is transforming coaching from a reactive guessing game into a precision tool for growth.

Enter TruRating – behavior signal at transaction scale

If mystery shopping is episodic, and NPS is emotional, what we’re missing is the behavioral layer: the real-time, at-scale, execution signal that tells us:

- What actually happened in the interaction

- Who did it, when, and how consistently

- What shifted behaviorally before performance moved

That’s what TruRating delivers. Not sentiment. Not snapshot. Signal. At the point of experience. At the speed of retail.

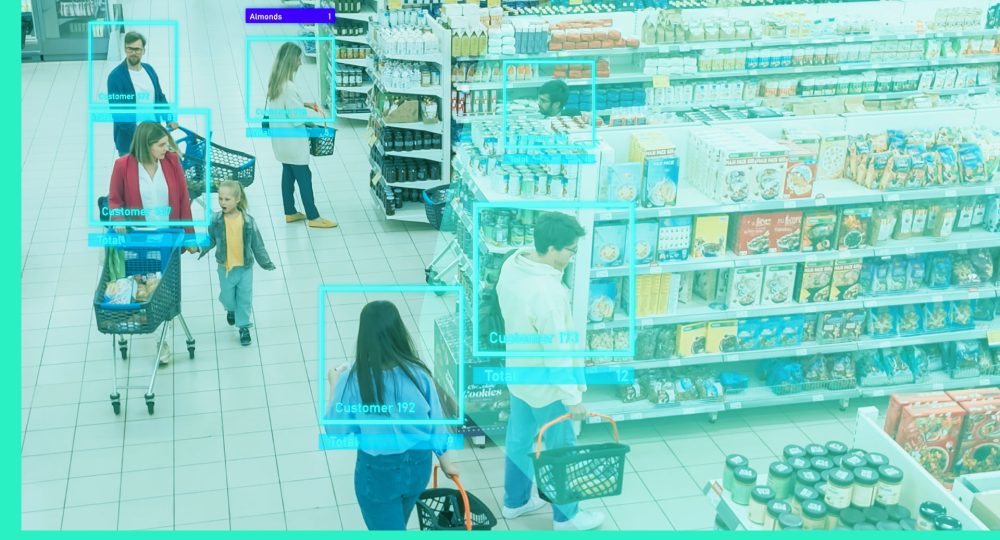

The TruRating model

TruRating is built on one deceptively powerful mechanic:

Ask one question per customer, per transaction right at checkout.

No survey fatigue. No sampling bias. No gamification. Just clean, behavioral signal with 80–90% response rates across every shift, every store, every day. But what makes it transformative isn’t the response rate.

It’s the precision of what’s being measured.

TruRating questions aren’t vague satisfaction polls or “how did we do” fluff. They’re targeted behavioral indicators designed to track:

- Was the customer greeted?

- Did the associate explain the loyalty program?

- Was product knowledge clearly communicated?

- Did checkout feel efficient and smooth?

These aren’t opinions. They’re executional behaviors tied to your brand’s service model. And because they’re captured in the moment, not post-visit, you can trust them to reflect reality not retroactive rationalization.

Why this changes everything

With behavior-level signal at transaction scale, you unlock:

Shift-Level Visibility

No more waiting for mystery shops or chasing weekly promoter score rollups. You can see how your team is performing right now store by store, associate by associate, shift by shift.

Smart Coaching

Field leaders no longer guess what to focus on. They get a live dashboard of which behaviors are being executed, and which are falling off so coaching becomes precise, relevant, and high-impact.

Closed-Loop Enablement

TruRating bridges the gap between strategy design and execution delivery. You can see exactly where new initiatives are landing, where they’re not, and why allowing for agile pivots, not post-mortems.

Proof of Execution → Proof of Impact

You can finally tie what the team did to what the customer felt and what the business earned. Behavior drives performance. Now you can see the chain in motion.

From compliance theater to performance truth

This isn’t about adding another dashboard. It’s about replacing an entire mindset. For too long, we’ve tried to coach behavior using lagging indicators, episodic snapshots, and subjective sentiment.

TruRating flips the system:

- From anecdote → to signal

- From audit → to enablement

- From scoreboard → to action plan

- From “we think” → to “we know”

“You don’t need more data, you need the right data. The kind that turns store visits into coaching moments and frontline feedback into performance levers.”

That’s what happens when you operate with a Retail Performance Layer. And that’s why TruRating isn’t a feedback tool. It’s an execution system.

In the final section, we’ll bring it all home with a no-nonsense breakdown of what happens when you keep relying on legacy tools, and the transformational unlock when you shift to real-time behavior signal.

Coaching without signal is just guesswork dressed in a polo shirt

Let’s stop pretending. We are not short on tools in retail. We are drowning in dashboards. But most of them don’t show us what matters. Mystery shops tell us what one person experienced, once, under observation.

NPS tells us how people felt after the fact, with no behavioral context.

Both are lagging, partial, and easily manipulated. And yet, we still ask store managers to hit performance goals using tools that show them only shadows.

It’s like trying to coach a football team by watching highlight reels after the game ended without ever seeing the plays being run. And here’s the truth every high-performing operator already knows in their gut:

You can’t coach what you can’t see. And if you can’t see it at the moment it happens, you’re not coaching execution, you’re narrating outcomes.

The hidden cost of staying stuck

Every day you run your retail operation on legacy tools, three things happen:

- You miss what’s really happening in your stores.

- You misdiagnose the source of performance variation.

- You lose credibility with your field and your customers.

Strategy becomes delayed. Coaching becomes diluted. Performance becomes distorted. And while everyone’s busy debating dashboards and sentiment trends, your competitors are building feedback loops that drive behavior change in real time because they’re not guessing. They’re operating with signal.

The shift is already underway

The top operators in the world aren’t waiting for quarterly reports. They’re building modern performance systems that give them:

- Daily, shift-level insight into execution behavior

- Coaching frameworks powered by live signal, not lagging sentiment

- A direct link between what teams do and what customers feel

- Proof that initiatives are landing, not just launched

This is what we call the Retail Performance Layer. And it’s already changing the way retail works from store ops to CX to strategy.

The new standard

So if you’re still relying on mystery shops and NPS to drive execution… You’re not coaching performance.

You’re just dressing up guesswork in a branded polo shirt.

The path forward is clear:

- Equip your teams with live, behavioral signal

- Coach based on what’s actually happening

- Validate strategy through in-the-moment adoption

- Build execution systems that compound impact not just monitor activity

Because the brands that win in modern retail aren’t the ones who measure the most. They’re the ones who see the truth fast, act on it early, and scale behavior that works.

Real performance isn’t measured. It’s performed. And it starts with signal you can trust.