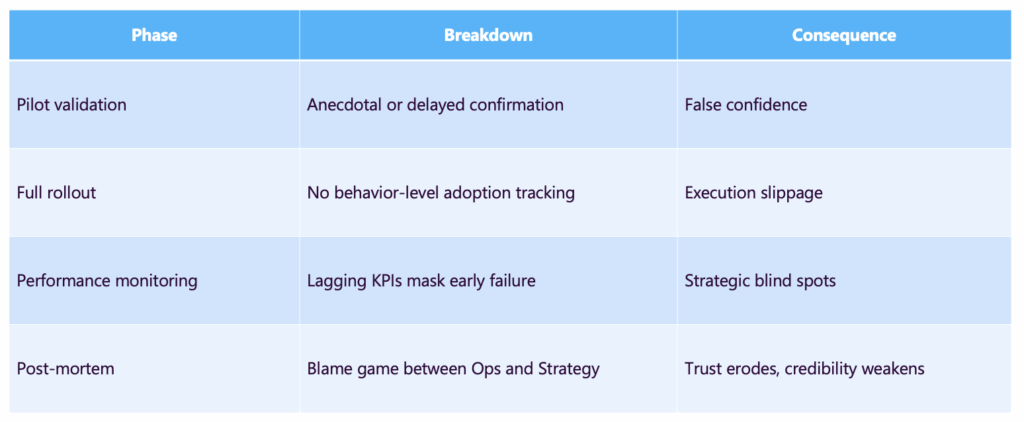

Retailers love pilots. When executed well, they’re the proving ground for transformation. But too often, they end with a familiar refrain: “The pilot looked good, but the rollout stalled.” This pattern repeats everywhere:

- Strategy teams launch a new checkout model, service script, or staffing standard.

- A high-touch pilot yields encouraging results in a few locations.

- Faith builds, rollout begins fleet-wide.

- Execution falls short. Sales flatten. Expectations slide. Fingers are pointed.

- Strategy gets blamed. Operations defends itself. And collectively, no one learns what actually went wrong.

This isn’t incompetence. It’s a pilot validation failure. And in this blog, we’re going to look at why this happens.

The root of the problem – confirmation over data

Retail leaders often rely on three weak pillars to validate a pilot:

- Top-down anecdotal feedback (e.g., a VP visits a pilot store and sees smiles)

- POS trends that take weeks or months to materialize

- Promoter or VoC scores collected days after transactions, often at aggregate level

Confirmation bias reigns: if the pilot team sees laptops performing well in a few stores, they interpret it as scalable success, regardless of broader adoption.

One global department store retailer we’ve partnered with originally stressed this regarding in-store pilots, “Ops is accountable for rollout performance, but wasn’t involved in validating the pilot. When things break down, they get blamed; even though they had no proof that the initiative was ready to scale.” This clearly indicates that pilot visibility breakdowns and lack of data during validation led to misattributed blame for failed rollouts. Because in retail, good pilots often fail not in design, but in validation.

POS data lags too much to guide rollouts

POS systems are powerful: they collect revenue, traffic, basket, and product performance data in real time. But here’s the catch:

- They reflect on what happened, not what broke.

- Analysis often happens days or weeks later.

- Execution confirmation can’t be linked back to behavior.

When conversion stalls post-rollout, POS says “it dropped,” but it can’t say why on Monday or where or when execution broke down. Without in-flight signal, strategy teams are left in limbo until months later.

A retail strategy leader for a global footwear company shared this with us early in our partnership, “Pilots stall out due to lack of measurable success criteria. Format initiatives judged on gut feel or lagging sales trends.” Strategy teams confirm pilots fail when decisions rely on gut feel or lagging data, not real-time validation.

Promoter score and VoC are not adoption signals

As critical as customer sentiment is, NPS and VoC programs suffer from two limitations:

- They are lagging–feedback lands too late to influence rollout execution.

- They are aggregated–theme-based scores don’t tell you which shift or store degraded execution.

In other words, these tools tell you how customers felt, but not whether trained behaviors were actually delivered where they were meant to.

The operating loop is broken

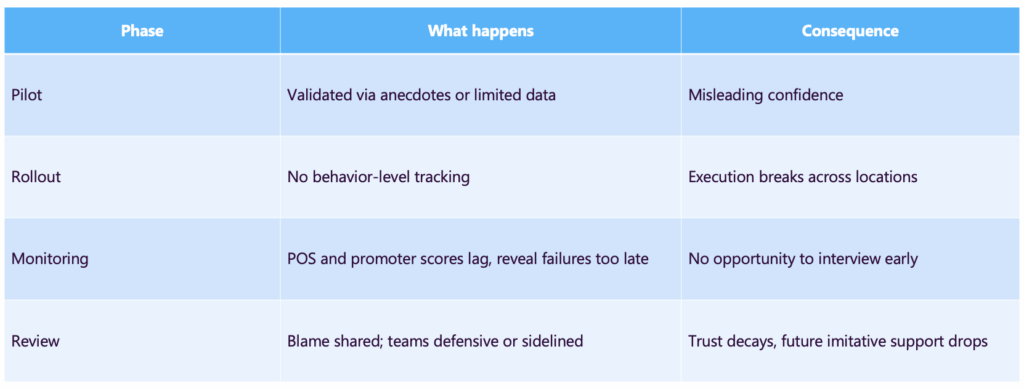

Because execution can’t be validated in real time, retailers fall into a destructive cycle:

When your validation system is broken, even a winning idea becomes a risky bet. The result? Strategy teams lose influence because they lack execution proof. Store operations are blamed for poor rollout outcomes despite never receiving the behavior feedback needed to execute well. Every failed rollout chips away at trust. The crux is that without real-time behavioral validation, pilots become guesswork—not insight-led performance.

The operational fallout

When your pilot validation system is broken, it’s not just strategy execution that suffers; it’s your entire organizational trust, decision-making, and performance trajectory.

Store operations become the scapegoat

Here’s how the breakdown plays out operationally:

- A pilot rolls out across 200 stores.

- Execution frays but no one knows where it went wrong.

- Performance stalls.

- Operations leadership becomes the default target: “Rollout failed – why didn’t it land on the ground?”

- Ops teams defend themselves: “We trained them.” “The field was ready.” “We told HQ staffing was off.”

Without proper validation, the root issue (missing behavior signal) is obscured. Operations gets blamed for failure they couldn’t detect or prevent.

Strategy loses Influence

In a well-functioning rollout cycle, strategy and CX teams:

- Create hypotheses

- Design pilots

- Monitor adoption

- Scale the successful parts

- Abort or pivot poorly adopted ones

But when you don’t have behavioral validation:

- Strategy leaders can’t prove adoption at scale

- They can’t isolate design flaws from execution breakdown

- Their recommendations lack traction

- Budget and power shift away from strategy teams and toward whoever “owns” execution

This diminishes their ability to drive continuous improvement.

Data shock leads to reactive chaos

Here’s what happens in data-driven collapse:

- Lagging indicators mean insights arrive too late; often months after rollout begins.

- Positional dashboards report some sales uptick, but it’s attributed to external factors.

- NPS shows modest change, but no context, no location granularity.

- Plans to re-coach, re-launch, or re-invest hinge on gut, not data.

The result is friction and confusion, not clarity:

“We don’t know why it tanked.”

“Do we pull the format or re-train store teams?”

“Can someone explain the performance delta between Region A and Region F?”

Without in-flight signal, the clear answer never comes.

Industry reinforces the failure pattern

Over 50–80% of pilot programs fail to scale—not because ideas are bad, but because strategies overestimate scalability and underestimate execution variability GoverningMIT Sloan Management Review.

The pattern is familiar across industries:

- Confirmed success in a small test group, but poor performance at enterprise scale.

- Execution fidelity drops below pilot levels.

- Feedback becomes delayed or nonexistent.

As one expert summarises, “companies overrate pilot scalability and under-invest in readiness.”

The broken rollout loop

This loop doesn’t just stall one rollout—it weakens your organization’s ability to execute at scale time after time.

Consequences you feel

- Ops teams: Over where they have no visibility, blamed for poor outcomes they couldn’t prevent.

- Strategy teams: Lose credibility and budget over ambiguous performance data.

- Leadership: Trends become reactive, trigger-based responses to lagging indicators.

- Culture: The initiative becomes risky; teams become risk-averse.

Without real-time validation, your rollout becomes a leap in the dark with costly consequences.

Up next we’ll explore how a system of real-time behavioral signal flips the validation loop; from guesswork and delay to clarity and execution assurance in our next section.

Real-time signal – the missing link

If rollout failure has a root cause, it’s this:

Most retailers have no way to validate execution in real time, at scale, and at the behavior level.

They launch new experiences, train store teams, and hope it sticks relying on anecdote, lagging KPIs, and week-old VoC summaries to infer success. That’s not a feedback loop. That’s a delay loop.

The Retail Performance Layer flips that. Instead of waiting to see if it worked, we instrument the frontline to answer a far more powerful question, “Is it actually being executed… right now?” That’s where real-time signal comes in.

What is real-time signal?

Real-time signal is not just more data. It’s a new operating system for decision-making. One that detects whether trained behaviors, new models, or CX standards are being consistently delivered store-by-store, shift-by-shift, hour-by-hour. It’s not customer opinion. It’s operational validation. This includes:

- Whether store teams are offering multiple product options

- If loyalty benefits are being explained at checkout

- Whether the new welcome flow is being delivered

- If product knowledge levels are translating into meaningful customer guidance

Each of these are execution-critical behaviors and they’re invisible in traditional POS, NPS, or VoC tools. TruRating turns them into live, trackable, and coachable metrics at scale.

How real-time signal changes the rollout loop

Here’s what changes when real-time behavior signal is introduced into your pilot and rollout strategy:

Before real-time signal:

- HQ waits 30–60 days for revenue lift trends.

- NPS filters in slowly and vaguely.

- Field feedback is anecdotal and incomplete.

- Strategy leaders cross their fingers.

With real-time signal:

- Within 72 hours, you know which stores adopted the behavior.

- You can track adoption by time of day, associate, or traffic band.

- Coaching can be delivered in the moment on the exact behavior that’s failing.

- Decisions to accelerate, adapt, or halt rollout are grounded in data not hope.

It’s not about dashboards. It’s about knowing what’s working, where, and why; before you commit to scale.

Faster, smarter go/no-go decisions

With a Retail Performance Layer in place:

- You can launch a pilot across 10 stores and know within 1 week where the behavior landed.

- Instead of running a 90-day rollout blind, you get daily signal that flags friction before it becomes revenue drag.

- You shift from “Did it work?” to “Where is it working, and how do we coach the rest?”

This is initiative intelligence – live, local, and linked to outcomes. And it changes how the business behaves.

The strategic impact

Let’s be clear: this isn’t just about operational efficiency. It’s about protecting the credibility of your strategic roadmap. Real-time signal allows:

- Strategy teams to prove initiative adoption and course-correct early

- Store operations to coach faster and replicate what’s working

- Finance and executive teams to de-risk investment and accelerate scale with confidence

The fastest way to destroy trust in a strategy team is to scale an initiative without validating adoption. The fastest way to rebuild that trust is to show exactly where it’s working and why.

In the next section, we’ll walk through a real-world use case where a new service model rollout succeeded not because of luck or lagging reports, but because real-time signal guided every step. Because in high-performance retail, execution is not assumed. It’s verified.

Use case – strategic initiative validation

Let me show you what it looks like when real-time signal turns a fragile pilot into a confident, controlled rollout.

The initiative – a new service model to drive upsell

A global specialty retailer wanted to roll out a new assisted-selling experience aimed at increasing basket size. The model emphasized:

- Proactive greeting and guided discovery

- Offering at least two additional items at checkout

- Explaining loyalty perks in every qualifying transaction

The pilot launched in 15 high-volume stores. The goals were clear: improve conversion and ATV by delivering a more consultative service experience. On paper, it was solid. They had:

- Trained all associates

- Reinforced the model through morning huddles

- Sent field leaders to shadow and coach

But what they didn’t have was proof that the behavior was landing consistently. And without it, every decision to scale the initiative was based on lagging sales data, anecdotal feedback, and NPS heatmaps—none of which confirmed whether the trained behaviors were actually showing up across shifts. So they turned to TruRating to layer in real-time behavioral signal.

The activation – real-time behavioral signal embedded at checkout

Each store was equipped to ask one question per customer, per transaction rotated strategically over the course of the rollout:

- “Did a team member offer you additional products today?”

- “Were your loyalty benefits explained during checkout?”

- “Did the staff help you discover new items you weren’t originally shopping for?”

These weren’t post-purchase surveys. They were live, high-volume micro-signals capturing execution fidelity while the customer experience was still fresh and capturing 80%+ response rates across all stores.

Within the first 7 days, the story was clear:

- Only 4 of the 15 stores were consistently delivering all three behaviors.

- 6 stores had a major drop-off during evening shifts.

- 3 stores showed strong training awareness, but inconsistent application during peak traffic.

And most critically, conversion and ATV lifts were only showing up in the locations where behaviors were executed reliably.

The intervention – targeted coaching, data-backed prioritization

Instead of treating the pilot as “one unified program,” the team now had store-level, behavior-specific data. That changed everything:

- District leaders stopped rotating blindly and focused on the 6 underperforming stores.

- HQ sent short-form reinforcement content tied to the exact behavior gaps surfacing in the data.

- One store completely rebuilt its evening staffing model after seeing consistent falloff after 5pm.

And guess what? Within 3 weeks:

- All 15 stores achieved consistent behavior adoption across dayparts.

- ATV improved by 11.2% across the pilot group.

- Store managers reported increased clarity on coaching priorities and higher team engagement.

The decision to scale

With real-time signal in hand, the business could now make a confident, fast decision:

- Which store types are ready to scale

- Which behaviors correlate most with lift

- What execution risks must be managed in rollout phases

No guesswork. No hoping. And because the performance layer didn’t end with the pilot, they continued tracking adoption throughout the rollout ensuring stores didn’t just “launch,” but sustain the new model. They didn’t just validate the idea. They validated the execution. And that’s what scaled.

What this proves

This isn’t just a nice-to-have. It’s a new strategic capability:

- Real-time behavior data exposes the why behind the what

- Coaching becomes precise, proactive, and high leverage

- Strategy gains internal credibility not from ideas, but from verified adoption

- Risk is contained. ROI is accelerated. And rollout performance becomes predictable

That’s what happens when you install a Retail Performance Layer that sits beneath your ideas and validates them into action. In the final section of this blog, we’ll zoom out and show you what this means for your business and why the most innovative retailers are no longer scaling pilots based on gut, but on verified performance intelligence.

What this means for your business

Let’s make this plain. If your current system of pilot validation relies on POS trendlines, field anecdotes, or once-a-week sentiment score dashboards, you are not validating execution. You’re validating outcomes without context. And that means every rollout you greenlight is a gamble.

You’re scaling strategy without proof of execution.

That’s like approving a national campaign without confirming the assets loaded in-market. It’s like launching a new format without knowing if the floorplan was built to spec. It’s like blaming the store team for a failed initiative when they were flying blind the entire time.

This is not a problem of people. It’s a problem of visibility. And it’s costing you trust, budget, and growth.

The risks of a broken validation loop

When you launch without real-time feedback:

- Strategy teams lose internal credibility.

- Operations teams are set up to fail.

- Field leaders are forced to coach based on assumptions, not proof.

- Pilots underdeliver, scale too soon, or get killed too early.

Worse: initiatives that could have transformed performance die quietly. Not because they were wrong, but because they weren’t seen clearly enough to be saved. In a world where every initiative must earn ROI fast, hope is not a validation method.

The Retail Performance Layer fixes the foundation

By installing a Retail Performance Layer powered by real-time, behavior-level signal, you don’t just upgrade your reporting, you reinvent your rollout system:

- You validate the strategy before it scales.

- You pinpoint adoption gaps as they happen.

- You coach field teams on what actually matters.

- You build a culture of continuous performance, not episodic reaction.

This isn’t about analytics. It’s about action. It’s not about promoter scores. It’s about execution fidelity at scale.

The payoff – faster decisions, stronger rollouts, repeatable wins

The brands that win in the next decade will not be the ones with the flashiest concepts.

They’ll be the ones who can operationalize ideas into behavior faster, more precisely, and more reliably than their competitors.

- Strategy gains confidence.

- Store leaders gain clarity.

- The entire business gains momentum.

And rollout failure becomes the exception, not the expectation.

One system shift. Entire business impact.

If you’re serious about scaling strategy with confidence, if you’re tired of guessing whether your frontline is delivering what you trained, and if you’re ready to stop blaming stores and start empowering them, then it’s time to build the missing system your rollouts have needed all along.

TruRating doesn’t just give you feedback. It gives you execution intelligence. And that’s the difference between a promising pilot and a transformative rollout.

Let’s talk. I’ll show you where your pilot is breaking down and how to fix it before the next one fails.