In 2026, pricing isn’t just a number on a shelf edge. It’s a trust signal. Shoppers are more value-aware, quicker to compare, and more willing to walk if a price doesn’t feel fair. That’s why retail pricing analytics has moved from a specialist function to a core operating capability. It’s how retailers stay competitive without defaulting to blanket discounting that slowly erodes profit.

Deloitte’s latest retail outlook frames this as a structural shift. Value-seeking behaviour isn’t a short-term hangover from inflation, it’s becoming a baseline expectation. At the same time, retail leaders are under pressure to improve margins and productivity while managing disruption in trade, costs, and demand. The result is a tougher pricing environment with more scrutiny, less forgiveness, and higher stakes for getting price architecture, promotions, and markdown timing right.

This is where pricing analytics in retail earns its keep. The goal isn’t to chase the “perfect” price. It’s to make better pricing decisions more consistently, by understanding elasticity, promo quality, and inventory risk at item and store-cluster level. And as AI investment accelerates across retail, the advantage won’t go to teams with the most dashboards. It will go to teams that canturn insight into growth faster, with guardrails that protect margin and price perception.

This article breaks down how pricing analytics retail teams use in practice works, the KPIs worth tracking, where retail pricing predictive analytics and dynamic pricing retail analytics fit, and how to separate true pricing problems from execution friction that distorts demand signals.

What is pricing analytics in retail?

Pricing analytics in retail is the process of using data to understand how price affects sales, profit margins, and customer response, by SKU, category, store cluster, and channel. It helps you answer simple but expensive questions:

- Where are we discounting when we don’t need to?

- Which items are truly price-sensitive (and which aren’t)?

- Which promotions grow the category vs cannibalize it?

- Where is price perception hurting conversion even if demand exists?

The point of pricing analytics is to make pricing decisions that hold up when demand shifts, inventory tightens, or competitors move.

How retail pricing analytics works

Pricing analytics retail teams rely on works best as a loop of collect the right inputs, turn them into usable insight, then make controlled changes you can measure.

Data sources that matter

For retail pricing analytics, start with clean internal data before you chase external signals:

- Transaction-level sales (units, price paid, markdowns, returns)

- Product hierarchy and attributes (brand, size, pack, seasonality)

- Promotions (mechanic, depth, duration, placement)

- Inventory signals (on-hand, OOS, weeks of supply)

- Costs (COGS, freight changes where possible)

- Competitive pricing on matched KVIs (where relevant)

- Loyalty or cohort flags (new vs repeat, deal-prone vs convenience-led)

- Customer perception (of value and experience)

If you can’t reliably answer “what did customers actually pay?”, your conclusions will drift fast.

Cleaning and segmentation

Most pricing failures come from averages that hide reality. Segment early by:

- Store clusters (urban vs suburban, premium vs value-led)

- Region (competition density, local wages, local demand)

- Channel (online vs in-store)

- Customer cohort (loyal vs first-time, deal-seekers vs regulars)

This is also where pricing strategies become practical. A “one national price” approach can still work, but you need visibility into where it’s over- or under-performing.

Retail analytics pricing intelligence

Retail analytics pricing intelligence (often shortened to pricing intelligence) is the monitoring layer that tells you what needs attention now, not what happened last quarter. In practice, pricing intelligence is used to:

- Track price compliance (intended vs shelf vs online)

- Spot margin anomalies early (not after month-end)

- Detect competitor gap changes on KVIs that shape price perception

- Flag promo performance issues while the promo is still live

This matters because customers don’t judge price item-by-item forever. They form a store-level impression. EY has highlighted that many retailers invest heavily in pricing and promotions but still struggle to shift perceived price position.

AI analytics impact on retail pricing strategies

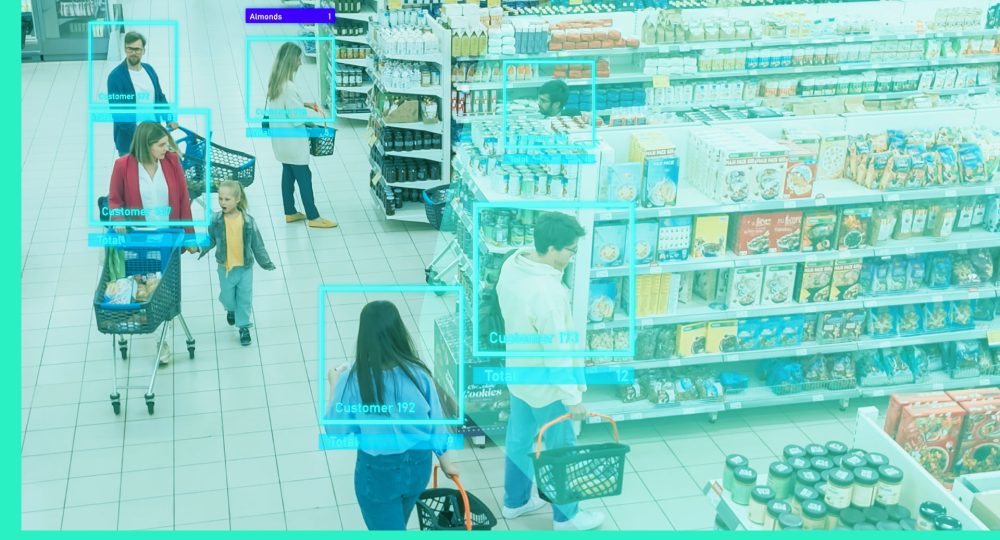

AI is making retail pricing analytics faster and more specific. Instead of pricing to averages, teams can use AI to spot patterns by store cluster, channel, and customer cohort, then make cleaner pricing decisions with fewer blanket discounts.

Where AI helps most

1. Demand and elasticity, at the right level

AI improves forecasting and elasticity estimates so pricing analytics in retail can reflect local reality (premium vs value stores, regions, online vs in-store).

2. Promo and markdown precision

AI can predict promo lift and cannibalization risk, and guide markdown timing using sell-through and weeks of supply, helping protect profit margins.

3. Pricing intelligence and anomaly alerts

AI flags margin drops, competitor gap shifts on KVIs, and price compliance issues early, so action happens while it still matters.

4. Scenario testing for pricing strategies

Quick “what if” modelling supports better pricing strategies, like holding KVIs while using price optimization models to improve margin on less-visible items.

The guardrails you need

AI doesn’t replace judgment. To keep AI-driven pricing decisions safe, build in:

- Margin floors and KVI boundaries

- Approval workflows and change frequency limits

- Audit trails (what changed and why)

- Test-and-learn routines (cluster tests, clear success metrics)

- Don’t misread friction as price

AI can misdiagnose demand if the real issue is execution, out-of-stocks, queues, confusing promos, inconsistent service. Pairing pricing analytics with real-time customer feedback (like TruRating’s in-the-moment ratings) helps teams see when it’s an experience problem, not a price problem, so they don’t discount unnecessarily.

Retail pricing analytics KPIs to track

Retail pricing analytics KPIs should help you manage profit, demand response, promo quality, and inventory risk, without needing a data science team to get started.

Profit and margin KPIs

Start here, because revenue-only pricing decisions are how margin quietly disappears:

- Gross margin % and gross margin $

- Markdown % by category and lifecycle stage

- Promo margin rate (promo vs baseline)

- Price realization (planned vs actual price paid)

- Returns impact on net margin (important in apparel)

This is the “profit protection” set.

Demand and elasticity signals

You don’t need perfect elasticity models on day one. You need directional truth:

- Units per store per week at different price points

- Elasticity direction by SKU/category (sensitive vs resilient)

- Substitution patterns (what customers buy instead)

- Conversion proxy signals (where available)

Promo KPIs

Promos can inflate units while stealing sales from nearby items. Research on promotions consistently treats cannibalization as a core factor you need to quantify, not hand-wave.

Track:

- Incremental lift vs baseline

- Cannibalization (what the promo stole)

- Halo effect (basket impact)

- Post-promo dip (demand pulled forward)

The “post-promotion dip” is well documented in pricing literature and can be masked in aggregate reporting if you don’t control for other promo activity.

Inventory KPIs

Track:

- Sell-through %

- Weeks of supply

- Aging stock

- OOS rate (because it distorts demand signals)

How to use pricing analytics in retail

This is where pricing analytics in retail becomes practical. You’re not aiming for perfection. You’re aiming for fewer bad pricing decisions and faster learning.

Retail price optimization vs price optimization models

Retail price optimization is the discipline of improving price outcomes under real constraints (brand, margin floors, KVIs, competitor position, operational feasibility). Price optimization models are the tools (rules-based, statistical, or ML) that recommend price moves based on targets like margin or units. A clean way to separate them:

- Pricing analytics = explains what happened and why

- Price optimization models = suggest what to do next

- Pricing decisions = what you actually implement with governance

Learn more about retail pricing optimization.

Dynamic pricing retail analytics

Dynamic pricing retail analytics is about changing prices more frequently based on conditions (demand, inventory, competition, time). Online is the easiest place to do this because execution is simpler. In-store is harder because shelf labels, customer trust, and fairness perceptions matter.

Consumer trust is a real constraint. Research on algorithmic/dynamic pricing shows that price fluctuation can conflict with consumers’ desire for price stability and can affect trust and price search behaviour. Use dynamic approaches where you can explain and govern them:

- Clearance and end-of-life stock

- Time-bound events (predictable spikes)

- Online competitive items where price gaps change quickly

Avoid “surprise pricing” that feels inconsistent or unfair.

Retail pricing predictive analytics

Retail pricing predictive analytics uses historical patterns and current signals to forecast demand and likely price response. The win is planning:

- Better promo depth and timing

- Earlier markdown decisions (before inventory becomes toxic)

- More accurate demand forecasts that account for post-promo effects

Predictive doesn’t need to be perfect. It needs to be better than “last year plus a guess.”

Segmentation

Segmentation helps you avoid blanket discounts and protect margin where willingness to pay is higher. Common segmentation plays:

- Premium clusters: protect margin, reduce promo depth

- Value clusters: sharpen KVIs, protect price perception

- Regional variation: reflect local competition density

- Cohort offers: shift from broad promos to targeted value

Three quick examples

Example 1: Grocery KVIs

If you’re losing trips, it’s often a perception problem. McKinsey’s retail pricing work calls out the importance of key value categories/items (KVIs) in price strategy. A practical use:

- Identify the 30–100 items shoppers remember (your KVIs)

- Track competitor gaps weekly

- Keep those items within a tight range

- Earn margin back on less-visible items where elasticity is lower

That’s pricing intelligence plus segmentation, not blanket discounting.

Example 2: Apparel markdown timing

If weeks of supply is climbing and sell-through is stalling, markdowns become inevitable. The difference is whether you do it early and targeted, or late and panicked. A practical use:

- Create rules tied to weeks of supply and lifecycle stage

- Test smaller markdown steps earlier

- Track post-markdown demand and returns

Markdown optimization is widely framed as “timing + depth + frequency” guided by analytics, not across-the-board discounts.

Example 3: Beauty bundles

Beauty can be price-resilient in some ranges, but shoppers still want value. Instead of cutting price:

- Bundle high-margin complements

- Use cohort offers for new customers

- Measure attach rate and net margin impact

You’re still using retail pricing analytics, just changing the lever from “lower price” to “higher perceived value.”

30-day starter plan

Week 1: Set a price perception baseline (before you change anything)

- Add a simple “price perception” question into your in-moment feedback flow (keep it consistent across stores and shifts).

- Example: “Did prices feel fair for what you got?” (Yes / No)

- Break results out by store cluster, category, and time of day so you can see where price trust is weakest.

- Pull the matching operational context (OOS, queue time, promo signage issues) so you don’t blame price for execution friction.

Week 2: Fix price truth + stand up the core KPI set

- Validate transaction-level “price paid” (ticket vs promo vs markdown).

- Map clean product hierarchy and promo flags.

- Launch the baseline dashboard with gross margin, markdown %, promo margin rate, sell-through, weeks of supply, plus one KVI competitor gap view.

Week 3: Build pricing intelligence alerts and governance

- Alerts: margin anomalies, KVI competitor gaps, promo underperformance, price compliance exceptions.

- Governance: define who can change prices, what needs approval, and how often changes can happen.

Week 4: Run two controlled tests (and track perception alongside profit)

- Test 1: one targeted KVI move (tight range, clear rationale).

- Test 2: one promo tweak (depth or duration) in a defined store cluster.

- Measure: incremental lift, cannibalization, gross margin impact, and inventory movement.

- Also track price perception weekly in test vs control stores to confirm you’re improving value trust, not just shifting volume.

Day 30: Re-measure price perception and link it to outcomes

- Repeat the same price perception question and compare to Week 1 baseline.

- Review results by store cluster and category.

- Learn where perception improved and margins held, then scale carefully.

- Where perception dropped, check promo clarity, availability, and service consistency before changing price again.

- Lock in a simple cadence to review monthly perception check and weekly pricing intelligence review.

This keeps pricing changes grounded in what customers actually felt, not just what the dashboard implies, so you can protect margin without training shoppers to wait for discounts.

Common mistakes and why retail pricing analytics can fail

1. Bad data and missing governance

If price changes aren’t tracked cleanly, the system can’t learn.

2. Optimizing the wrong goal

If you optimise revenue, expect margin erosion.

3. Over-trusting averages

Segmenting is not “nice to have.” It’s how you avoid false conclusions.

4. Ignoring fairness and trust

Dynamic or algorithmic pricing that feels unstable can trigger distrust.

5. Not operationalizing decisions

You need a cadence of review, decide, implement, measure and learn.

Retail pricing analytics software checklist

When evaluating retail pricing analytics software, prioritise operational fit over feature volume:

- Integration (POS/ecomm/promo/inventory/product master/clean room)

- Scenario testing (“what if we raise X by 2% in cluster A?”)

- Governance (workflows, approvals, audit trails)

- Experimentation support (test-and-learn)

- Explainability (teams trust recommendations they can understand)

- Exception alerts (so humans focus where it matters)

How TruRating improves retail pricing analytics

Retail pricing analytics can tell you what changed in sales and margin. But it often can’t tell you why shoppers accepted a price, rejected it, or waited for a deal. That’s where pricing analytics in retail gets stronger when you can measure customer sentiment in-store.

TruRating captures in-the-moment customer feedback at the point of experience, so you can track whether prices felt fair or what the factors are that influence that fairness by store, shift/daypart, and team. That closes a gap most pricing programs have. With TruRating, you can separate true price resistance from execution friction like queues, out-of-stocks, confusing promos, or inconsistent service.

Pricing analytics retail teams use to avoid blanket discounting

When you can see price perception by store and daypart, you can stop treating “low conversion” as a pricing problem by default. Instead, you can:

- Protect margin where value is strong: If price perception is positive in certain stores/dayparts, you can hold price or reduce promo depth instead of discounting across the board.

- Target the real issue where value is weak: If shoppers say prices feel unfair, you can diagnose what’s driving it (price gaps on KVIs, promo clarity, availability, or service), before cutting price.

- Run tighter tests: Pair a small price moves with perception tracking to confirm you’re improving trust, not just shifting volume.

- Coach execution, not just change price: If perception drops mainly in a specific daypart, it’s often a staffing, availability, or queue issue. Fixing that can lift sales without touching price.

Retail pricing predictive analytics works better with perception signals

Retail pricing predictive analytics improves forecasts and recommendations, but the model is only as good as the signals it learns from. If poor execution depresses demand, the model can misread that as “customers won’t pay,” and recommend discounts you didn’t need.

Adding TruRating to your reporting helps teams interpret what the data is really saying, so pricing decisions don’t drift into blanket markdowns that train shoppers to wait for promotions.

Non-blanket pricing strategies need confidence. Store-level perception shows you where to be sharp (KVIs, value-led clusters) and where you can hold firm (premium clusters, strong execution dayparts). It also gives you a way to prove to stakeholders that you’re protecting profit margins and customer trust, because you can measure both.

If you want to see how TruRating helps retailers measure value and price perception in the moment, and turn that into clearer pricing decisions, learn more about our retail analytics software or book a demo to see it in action.

Useful resources

- Perceived value in retail – how experience shapes pricing, loyalty, and spend

- Retail conversion guide – definition, formula, benchmarks, fixes

- How to measure customer service – metrics and tools

- Real-time feedback and customer experience – the new standard for retail

- How to improve customer experience in retail stores

FAQs

What is retail pricing analytics used for?

Retail pricing analytics is used to decide where to hold price, where to sharpen it, and where to change promos or markdowns—based on observed demand response and margin impact. It’s most useful when it helps teams avoid broad discounts and instead focus on the few items, stores, or weeks where price is actually the blocker.

How do pricing analytics in retail support better pricing decisions week to week?

Pricing analytics in retail supports better pricing decisions by creating a repeatable rhythm: review exceptions (margin drops, KVI gaps, promo underperformance), choose a small set of actions, then measure what changed. Weekly cadence matters because price perception and competitor position can shift faster than monthly reporting cycles.

What’s the difference between pricing analytics retail reporting and retail price optimization?

Pricing analytics retail reporting tells you what happened and where performance moved. Retail price optimization is the process of selecting the next best price action under constraints (brand, margin floors, KVIs, operational feasibility). Optimization can be rules-based or model-driven, but it only works if the underlying analytics and data quality are solid.

What’s the role of pricing intelligence in retail analytics pricing decisions?

Retail analytics pricing intelligence helps you act earlier by flagging the things that tend to create silent margin loss such as competitor gap movement on KVIs, price compliance issues, and promos that are generating volume but not profit. It’s less about “more data” and more about focusing attention on exceptions that need action.

How do I estimate price elasticity without a full data science team?

Start directional. Look at how units and margin move when price changes (or when you run different promo depths) and compare results across store clusters and similar items. If you control for availability and promo mechanics, you can quickly separate “price-sensitive” items from “price-resilient” ones and prioritise where modelling effort is worth it.

When does dynamic pricing retail analytics make sense for physical stores?

Dynamic pricing retail analytics makes most sense where customers expect change and the rules are clear: clearance, end-of-life stock, or time-bound events. It’s riskier in everyday shelf pricing because frequent movement can damage trust. In-store “dynamic” often works better as controlled, scheduled adjustments rather than constant price changes.

How does retail pricing predictive analytics change planning?

Retail pricing predictive analytics helps teams plan promo depth, markdown timing, and inventory risk earlier, before margin is forced into panic discounts. The best use is scenario planning (“if demand softens, what price or promo move protects profit?”) rather than trying to automate every SKU decision.

How do you measure customer price perception alongside pricing analytics?

Use a consistent, simple measure in-store (and by daypart) such as “Did prices feel fair for what you got today?” and trend it by store cluster and category. Pair it with operational context (availability, queues, promo clarity). This helps confirm when price is the true issue versus when experience friction is distorting demand signals and leading to unnecessary discounting.