Last week we shared the first of a four-part look at the ways that inflation is impacting the retail landscape, with exclusive findings from our latest consumer report.

While in Part 1, we explored the varying impacts of inflation across the generations, in Part 2, we take a look at how the inflationary impact on essential consumptions, like groceries and petrol, is shaping the way the modern consumer approaches retail.

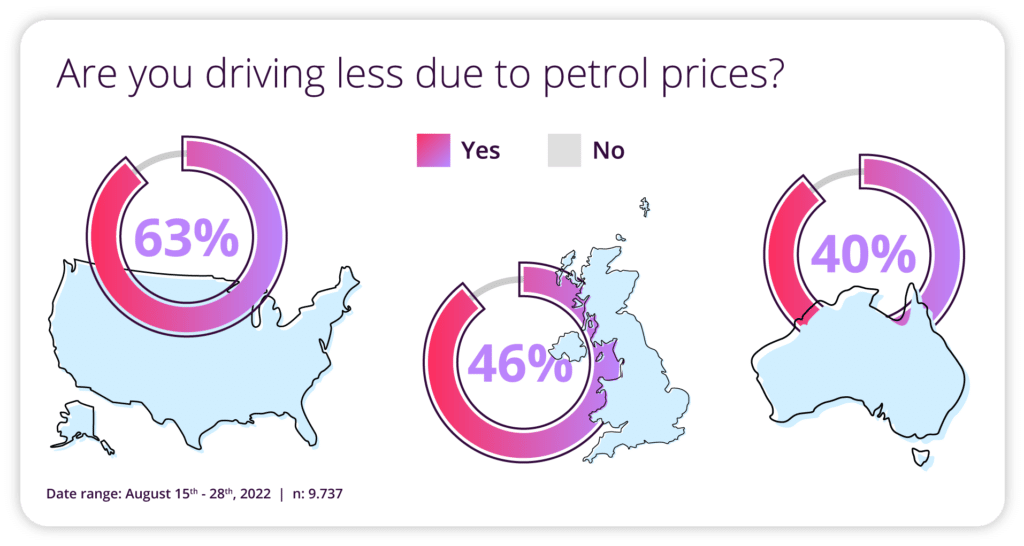

Although there is no simple way to present a truly global view of the impact of inflation, in this section, we take a look through the lens of 3 major global markets – North America, the UK, and Australasia.

The Data:

The Story:

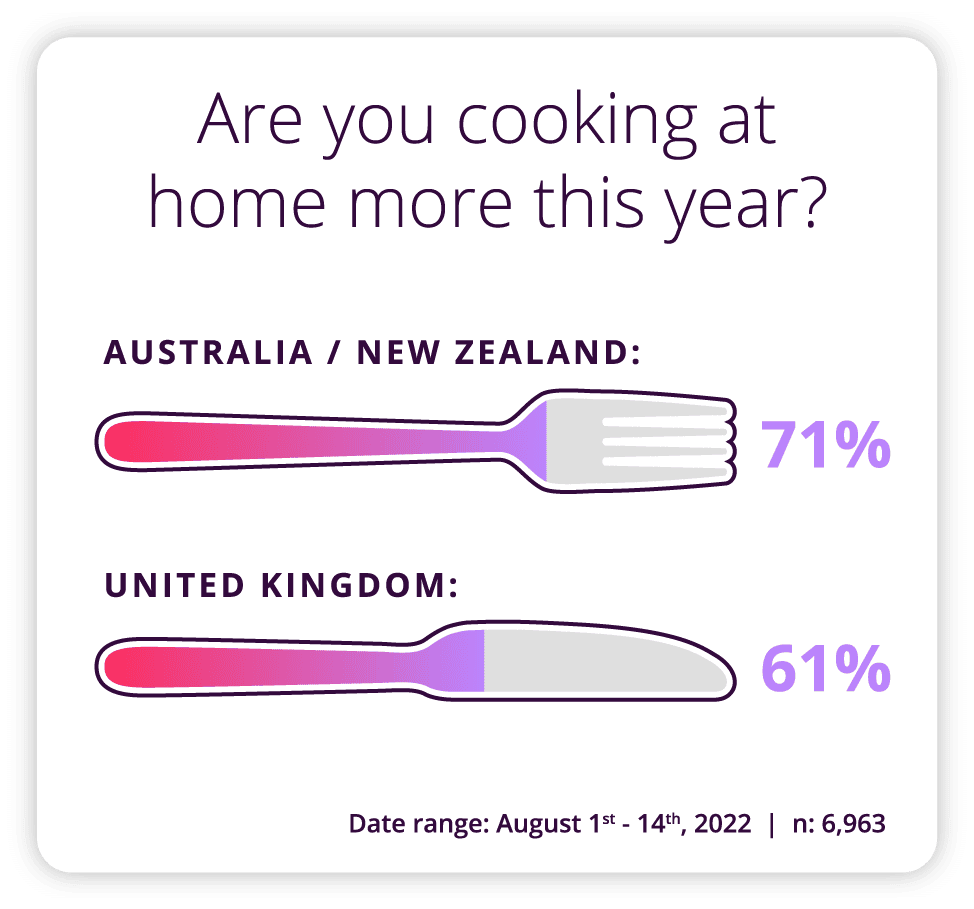

Though in 2022, we tend to view the world as a global marketplace, it’s important to remember that inflation rates are not equally felt in every region. In TruRating’s core operating markets, the inflation numbers for July 2022 vs. July 2021 were 6% for Australia, 8.5% for the US and 10.1% for the UK (Trading Economics – July 2022).

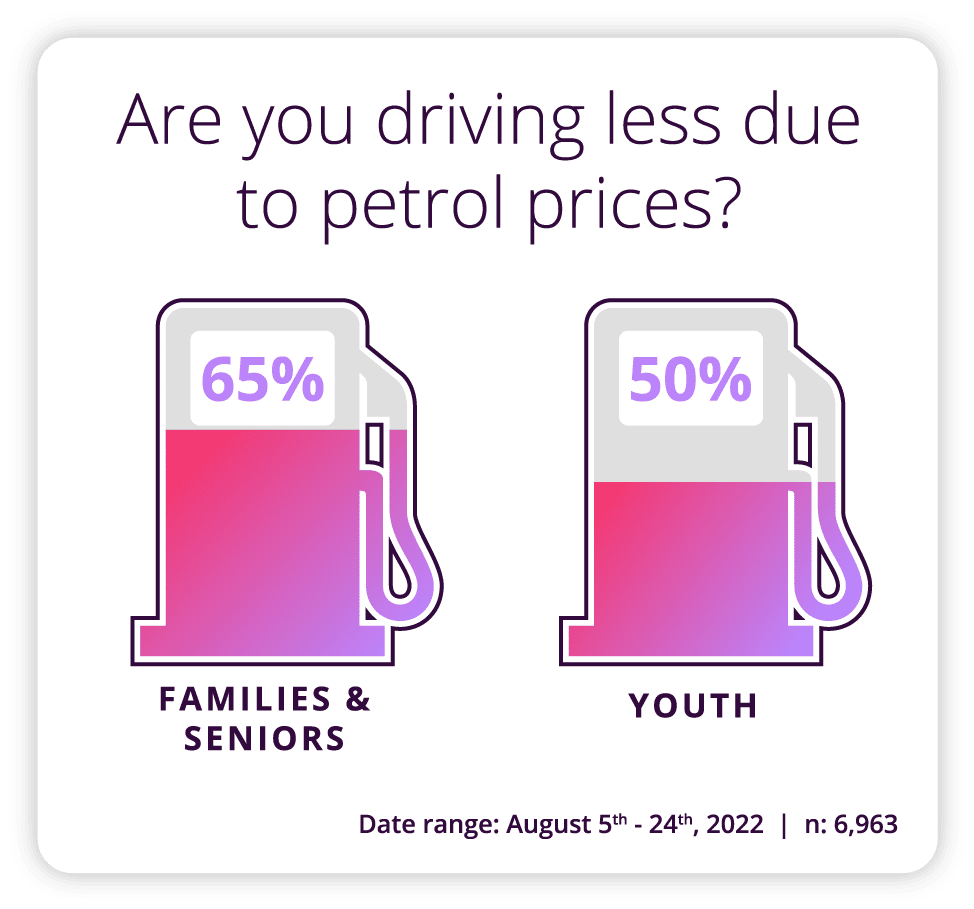

When we asked consumers in each of these regions specifically about the impact of inflationary effects on basic habits such as driving and food consumption, responses indicated that the degree to which these factors impact discretionary spending also varied.

From a retail perspective, the key consideration is one of location:

In markets where consumers are more heavily reliant on private transportation to simply get to the store itself, the size of a catchment area becomes increasingly significant.

Retailers who have invested strategically in store locations in densely populated Urban areas will have noticed the benefits already. The significance of inflation as an effect with varying impacts can be seen with younger, typically more affluent consumers (also those more likely to inhabit urban areas) feeling the impact of increasing costs for lifestyle ‘necessities’ (such as driving) less so than families and seniors.

Although the initial impulse may be to read any costs that bite into discretionary spending as a negative, it is important to consider the actions that can be taken to help build substantial long-term loyalty:

By helping your consumers to weather the storm of temporary cost increases, you can win long-term customer trust.

If customers go the extra mile to visit your stores, you must ensure that you deliver on the fundamentals when they are there. Going beyond expectations in a time of need will not be forgotten quickly.

Key Takeaways:

- In hard times, all footfall is more valuable than ever

- Help your customers now to win long-term trust and loyalty

- Challenging times present opportunities to exceed expectations

Retailer Tip:

By understanding which products and product lines have the strongest impact on your customers perception of brand value, you can mitigate potential losses by strategically increasing prices for products that have a less noticeable knock-on effect. And remember – your most loyal customers are likely to notice any price increases first.

- Are you testing pricing sensitivity by category and segment?

- Have you got the customer data to understand response to pricing adjustments in real-time?

- Do you know the potential impact of off-loading excess inventory at a discount on the perception of overall brand value?

Influencer View:

Consumers are now more price-conscious and more selective with how they will spend their money and where. It’s important for retailers to adjust prices to keep their margins as they are already tight enough, but consumers need to see the value in the price increase, which is a great opportunity to invest in loyalty programs, long-term offers, and subscription strategies.

Paula Macaggi, Head of Partnerships and Global Strategy, RETHINK Retail