In every retail business I’ve run, advised, or audited (regardless of size, sector, or sophistication) there’s always one universal truth:

- It’s not your top performers that define your trajectory.

- It’s your bottom quartile that quietly drags you down.

These are the stores that miss their plan by a few points every quarter. The ones no one flags in the QBR because “it’s always been a tough region.” The stores that blend into the aggregate metrics – never catastrophic enough to escalate, never strong enough to showcase.

But here’s the reality: Your bottom 25% of stores are likely costing you more than any failed pilot, price misfire, or ad campaign ever could. And you probably don’t even know it. Because these stores rarely sound alarms. They don’t show up in incident reports. They don’t crash systems or trigger social sentiment spikes. Instead, they slowly, silently underperform; not because of strategy failure, but because of invisible execution gaps.

We’re not talking about bad locations or poor leadership. We’re talking about the slow erosion of performance that happens when there’s no system in place to monitor whether trained behaviors, new models, or service standards are actually being delivered.

That’s what this blog is about. It’s not a story of innovation. It’s a story of detection and of what happens when you finally build the layer that allows you to see.

In the next section, I’ll take you inside a real-world case: a national retail brand that used behavior-level signals to identify and address silent execution breakdowns across its lowest-performing stores. The result?

- An 8% conversion lift.

- Unlocked not through reinvention, but through real-time validation of the basics.

Because the truth is, most retailers don’t need more ideas. They need more visibility into whether the ideas they’ve already launched are being executed. Let’s dig in.

The bottom quartile pattern – underperformance without alarms

Every retail operator knows the top 10 stores. They get the dashboards, the shout-outs, the CEO walk-throughs. They’re the proof points we use to show the business what is possible. But ask yourself this: Do you know what’s happening in the bottom 25% of your fleet right now?

Not the disaster stores… the ones with staffing holes or flooding or a failed remodel. I’m talking about the quiet laggards. The ones that miss conversion goals by a few points each week. The stores that meet their loyalty sign-up targets, but never grow in basket size. The ones that “do okay” in promoter scores but never seem to hold onto repeat visits.

These stores don’t scream for help. They don’t escalate. They blend in. And that’s precisely what makes them dangerous. Here’s what we’ve consistently seen inside dozens of mid-market and enterprise retail orgs:

- The bottom quartile stores account for 50–70% of all missed revenue opportunity

- They’re not failing because of location, leadership, or product mix

- They’re failing because of behavioral inconsistency and invisible execution breakdowns

- And no one sees it because there’s no performance layer in place to detect it

Let’s be clear:

- POS data won’t surface it

- Promoter scores won’t explain it

- Mystery shops won’t catch it

- Store visits happen too late, too infrequently, and with too much bias

This is systemic. The entire retail operating model was built on a post-hoc cadence. We wait for sales to dip, complaints to rise, or reviews to drop and then we react. But the bottom quartile isn’t loud. It’s quiet. It just keeps… underdelivering. Quietly dragging the business down one missed behavior, one unexecuted service cue, one lost repeat customer at a time.

These stores don’t need a new strategy. They need a system to validate whether the current strategy is even being executed. And once you give them that system? The upside is massive.

In the next section, I’ll show you how one retailer used TruRating to pinpoint the exact behavior gaps in their underperforming stores and uncovered a huge revenue opportunity hiding in plain sight. Let’s get into the data.

Case study – how one retailer found the opportunity

Let me take you inside the system. A national specialty retailer known for its elevated in-store experience came to us with a familiar problem. Their top-tier stores were thriving, their loyalty program was performing well, and their customer satisfaction scores, on average, looked solid. But revenue growth was flat, conversion was stagnant, and, more importantly, a full quarter of their stores were consistently underperforming with no clear cause.

This wasn’t a leadership problem. It wasn’t a merchandising problem. It wasn’t even a traffic problem. It was an execution visibility problem.

The symptoms:

- Conversion rates across the bottom quartile were 8–12% lower than the fleet average

- Basket sizes were consistently below the projection

- Repeat customer behavior in these locations trailed the brand benchmark by weeks

But nothing in their existing systems could tell them why. Promoter scores were passable. POS trends were inconclusive. Mystery shop data was too infrequent to be directional. These stores weren’t failing dramatically. They were quietly decaying, and no one could explain it. That’s when we deployed TruRating as a Retail Performance Layer.

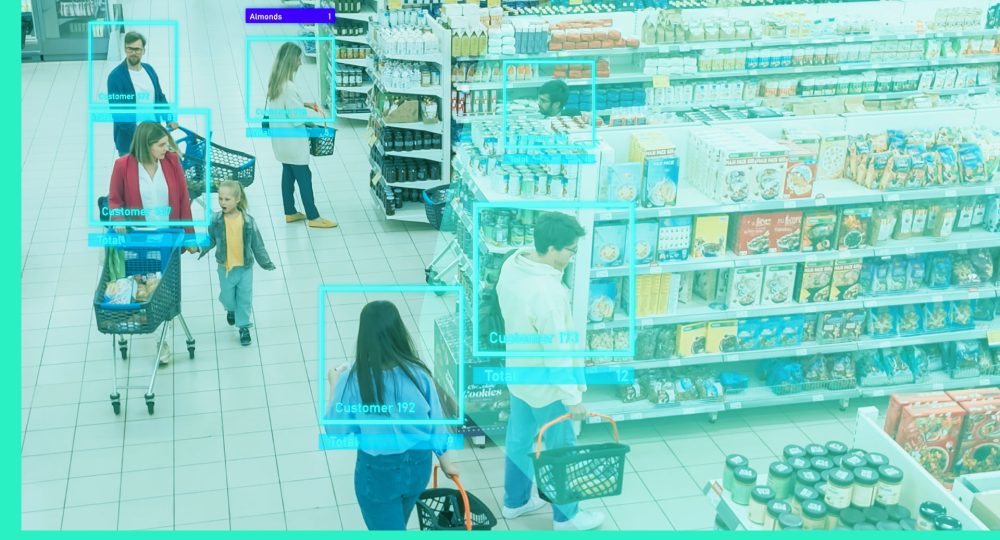

The intervention – embedding behavior-level signal

Here’s what we did differently. Instead of waiting for feedback after the fact, we instrumented the customer experience in the moment, at the point of transaction. Every customer was asked a single, context-specific question during checkout. These questions rotated based on what the business wanted to validate; ranging from service behaviors to friction touchpoints to brand execution elements. Examples:

- “Did a staff member recommend a product to you?”

- “Did a team member greet you when you entered the store?”

- “Was the store easy to navigate today?”

- “Did a staff member explain your benefits as a loyalty member?”

The brilliance wasn’t in the question. It was in the volume and timing of the signal. Response rates exceeded 85%+, giving the business real-time, statistically robust behavioral data from every store, every shift, every day. And what the data revealed was game-changing.

What we found – behavior gaps were driving conversion loss

In the bottom quartile stores, a clear pattern emerged:

- Associates were not consistently offering product recommendations.

- Service interactions were reactive, not proactive.

- Staff availability during key dayparts was inconsistent; particularly during high traffic evening hours.

- Execution of trained behaviors (like greeting, offer framing, and benefit explanation) varied widely; not just store-to-store, but shift-to-shift.

And here’s the kicker… In the stores that did execute these core behaviors consistently, conversion rates were 8% higher on average. Same product. Same pricing. Same floor plan. The only variable? Execution.

The business impact – $16.7M in modeled revenue upside

When we modeled the impact of lifting conversion in just the bottom 25% of stores by the 8% achieved in high-behavior compliance stores, the math was undeniable:

- Total annual revenue potential: $16.7 million

- Achieved with no new capital investment

- Realized through behavior change, not store remodels or markdowns

- Enabled by real-time signal and coaching, not post-hoc reports

And here’s what made the outcome sustainable:

- Store managers were equipped with dashboards highlighting which behaviors were being missed from shift-to-shift.

- Regional leaders were able to prioritize store visits based on behavior gaps, not just comp performance.

- HQ teams finally had execution visibility, enabling better rollout calibration and format design.

This wasn’t a reporting win. It was an operating model unlock. Most retailers think their performance problems are complex. But often, the biggest opportunity is stunningly simple: Make sure your stores are doing what you trained them to do and validate it daily. And to do that, you don’t need another survey platform. You need a Retail Performance Layer.

Why you can’t see this with traditional reporting

Let’s pause and ask the uncomfortable question: How did a huge opportunity sit unnoticed for years in the bottom quartile of stores? Simple. The retailer was running on the wrong feedback architecture. Despite having:

- A sophisticated POS system

- A robust VoC platform

- Regular mystery shops

- Weekly comp reporting

They were still blind to the root cause of performance erosion. Let’s break down why these legacy systems failed and why thousands of retailers today are in the same position.

POS data tells you what happened, not why

POS data is foundational. You need it to understand revenue, traffic, basket size, and product performance. But here’s what POS can’t do:

- Tell you whether staff delivered the new service model

- Show you which shift stopped explaining loyalty benefits

- Identify when customer effort spiked during checkout

- Detect whether product recommendations were made or not

POS is a rearview mirror. It gives you outcomes, but no insight into behavior or breakdown. It tells you what moved, not what broke. And that distinction matters. Because if conversion drops 6% in Store #206, POS can confirm it happened.

But it can’t tell you that during the evening shift, customers weren’t being greeted and staff weren’t offering the second or third product option. Without a Retail Performance Layer, you’re left to guess. And guesses don’t scale.

VoC platforms focus on feelings, not execution

Let’s be honest: the average customer experience program today is still structured around survey collection and theme reporting:

- Post-purchase.

- 2-3 days post-sale.

- And response rates are at an all-time low.

Promoter scores. CSAT. Post-purchase feedback. All useful. All necessary. But also: lagging, selective, and behaviorally ambiguous. You might learn that:

- “Customers are frustrated by long wait times”

- “Staff didn’t seem helpful”

- “It felt like no one was available on the floor”

But you won’t learn:

- Whether the new service behavior was attempted

- Which associates are consistently underdelivering key steps

- What percentage of customers experienced the issue firsthand

- Or how much it’s costing you in revenue per visit

Most VoC programs surface feelings without validating execution. They’re rich on themes but poor on precision. You can’t coach a store team off a thematic trend. You need behavior-level feedback, tied to financial outcomes. That’s what the Retail Performance Layer makes possible.

Mystery shops are episodic theater

Let’s talk about the most over-indexed and under-leveraged signal in retail: mystery shopping. Here’s the uncomfortable truth:

- Store teams prepare for mystery shops like a Broadway show.

- Standards are followed for a window and then forgotten.

- The feedback is episodic, inconsistent, and known to be gamed.

- Worse: it often arrives weeks after the visit, with little coaching value.

Mystery shops don’t reflect day-to-day performance. They reflect how well your teams can fake the standard when they think someone’s watching. They don’t expose execution inconsistency. They incentivize performance theater. And in a world where customer expectations evolve by the hour, mystery shops are a relic of a slower, less transparent era. You don’t need a secret shopper once a month. You need every customer to be your truth teller, every day.

The common failure mode – reporting without resolution

The thread tying all of this together? These tools were built to report, not to resolve. They were designed to answer:

- “What happened last week?”

- “How do customers feel?”

- “What’s trending across the fleet?”

But they don’t answer:

- “Which stores didn’t execute the trained behavior today?”

- “What’s costing us repeat visits in Region 2?”

- “Why are conversion and ATV stalling in Format B?”

- “Which shift needs coaching—right now?”

That’s the gap. And that’s why the $16.7M stayed hidden. Not because the tools failed. But because the system they were supporting wasn’t designed for in-the-moment performance management. That’s the function the Retail Performance Layer was built to fill. When you only manage lagging indicators, you only solve problems after they’ve already cost you. The Retail Performance Layer shifts you from explanation to execution. From lagging response to leading precision.

In the next section, I’ll show you what happens when you finally make that shift—and how TruRating doesn’t just expose the problem, but enables your teams to coach, correct, and scale what works in real time. Because the opportunity isn’t just to see more. It’s to perform better.

From insight to intervention – how TruRating changes the game

Most platforms stop at surfacing the problem. TruRating was built to solve it. This isn’t a reporting tool. It’s not a VoC clone. It’s not another dashboard competing for airtime at your next QBR. TruRating is a Retail Performance Layer, a live system that validates, localizes, and activates execution signal at scale.

The key shift? It’s not about knowing more. It’s about intervening sooner. Let me show you what that looks like in the field.

1. Store managers stop guessing and start coaching

Today’s store leaders are flying blind. They get:

- POS reports (what sold)

- Shift recaps (what happened)

- Maybe a Promoter score trend (how it felt)

But they rarely get feedback that connects behavior to outcome. With TruRating installed:

- Managers get daily dashboards showing how consistently key behaviors are executed

- They can see if greetings are being missed during the 5–9pm rush

- They know which associates need support delivering the trained experience model

- They’re empowered to coach in the moment; not a week later, after the damage is done

This turns store managers into performance coaches, not report recipients.

Because they finally have the signal they need to lead the floor.

2. Field leaders prioritize based on behavior gaps, not just sales trends

Most regional and district leaders spend their time reacting to red flags:

- “This store’s down 4 points week over week”

- “This location’s returns are spiking”

- “Let’s visit the stores with the lowest NPS”

That’s fine. But, it’s reactive. It’s imprecise. And it’s often too late. TruRating gives field teams the ability to:

- Prioritize store visits based on behavior non-compliance (e.g., 3-option offer rate dropped 20% this week)

- Segment coaching by shift, store, and behavior type

- Replicate top-performing behaviors across underperforming formats

- Correlate execution with ATV, conversion, and repeat rate in real time

It’s no longer “where should I go?” It’s “Where are we losing performance we could be reclaiming this week?”. Coaching isn’t about intuition anymore. It’s about targeting. TruRating makes performance gaps visible so your leaders can close them faster.

3. HQ can validate rollout success before it’s too late

Ask any retail strategy team what success looks like and they’ll tell you: “Adoption. Lift. Validation.” But here’s what actually happens:

- A pilot looks promising in five stores.

- It’s rolled out to 200 more.

- Sales don’t move. No one knows why.

- Finance starts cutting budget. Ops starts pointing fingers. Strategy starts second-guessing the playbook.

Why? Because no one ever measured whether the trained behaviors or format changes were actually adopted at scale. With TruRating, HQ teams get:

- Execution signal by store, region, shift, and format down to the behavioral layer

- Real-time views of rollout compliance

- A clear distinction between poor adoption vs. flawed design

- Early warning signals when a great idea is getting buried in inconsistent delivery

That’s not “insights.” That’s initiative defense. Strategy doesn’t die from bad ideas. It dies from unvalidated execution. TruRating keeps that from happening.

The net result – execution moves at the speed of strategy

When you install TruRating as your Retail Performance Layer:

- Strategy becomes scalable

- Coaching becomes targeted

- CX becomes measurable

- Revenue becomes repeatable

And bottom quartile stores? They stop being a liability and start becoming your fastest source of growth. Because what was once invisible is now actionable. And what was once anecdotal is now provable. You don’t need more feedback. You need a system that drives performance.

In the next (and final) section, I’ll break down exactly what this means for your brand and why closing your visibility gap could be the most valuable operational upgrade you make this year.

What this means for your business

Let’s pull the lens back. This isn’t just a case study. It’s a mirror. And if you’re running a fleet of 50, 100, 300+ stores right now without a performance layer in place, there’s a version of this opportunity sitting inside your network. Because here’s what we now know with certainty:

- Your strategy isn’t broken; your execution visibility is.

- Your bottom quartile isn’t underperforming due to product or pricing. It’s due to undetected behavior breakdowns.

- Your store managers aren’t disengaged. They’re just flying blind.

- And your field leaders aren’t ineffective. They’re under-instrumented.

Every week you operate without a Retail Performance Layer is a week you’re leaving money on the floor.

Not because your people aren’t capable. But because your system wasn’t designed to show them where and how to close the gap. Revenue is being lost in plain sight. Not because no one cares. Because no one can see.

What happens when you fix it

When you install a Retail Performance Layer like TruRating:

- You turn customer transactions into real-time performance validation.

- You convert “how are we doing?” into “what behavior is missing?”

- You give store and field leaders precision coaching tools grounded in live behavioral data.

- You defend rollout performance with data that’s causal, not correlative.

- And you reclaim lost revenue in your quietest, least prioritized stores— without adding a single SKU or marketing dollar.

You stop guessing. You stop generalizing. You start performing.

Not a feature. A system.

This isn’t another plug-in. It’s not a product pitch. It’s a foundational shift in how your retail business operates. If your team is still:

- Running pilots without behavior instrumentation

- Coaching based on gut, not signal

- Waiting weeks for survey rollups

- Measuring success only when the quarter closes

Then you don’t have a performance system. You have a reporting system. And that system is costing you growth, loyalty, and credibility… every day.

TruRating installs the missing layer. The layer that connects experience, behavior, and outcome store by store, shift by shift, in real time.

One layer. millions unlocked.

If your bottom 25% of stores lifted conversion by 4–6%, what would that be worth?

- $5M?

- $12M?

- $25M+ across global markets?

You don’t need to overhaul your brand. You don’t need to relaunch your loyalty program. You just need to know what’s happening at the front line and fix it fast. That’s what the Retail Performance Layer was built to do. And TruRating is how you do it.

Let’s stop reacting to red flags. Let’s start activating the opportunity that’s been hiding in your fleet all along. Let’s build the system that performs. Ready to uncover your opportunity? Let’s talk.