In my last article, I introduced the concept of the Retail Performance Layer, a system designed not to generate more reports but to finally close the gap between strategy and execution. As we’ve seen across every format, region, and rollout, it’s not the idea that fails. It’s the failure to see whether the idea was ever truly executed. And if you’re still operating without this layer, the cost isn’t theoretical. It’s compounding.

Retailers are leaking millions, not because of bad strategy but because they have no system to detect execution breakdowns until it’s too late. In this article, we will look at what that really means in practice, including the hidden cost of failed pilots, behavior breakdowns, and brand erosion that you can’t see on a dashboard… until it hits your P&L.

Pilots that “work” in theory, but fail in reality

Here’s a pattern I’ve seen at every level of retail:

- A new checkout model is rolled out

- A pricing experiment is tested

- A service behavior is trained across the fleet

The pilot results look promising. Maybe one region nails it. Maybe the NPS nudges up. So the team greenlights the rollout. But months later, the results stall. The sales lift never scales. The customer experience degrades in unpredictable ways. Why? Because no one validated execution quality across the rollout. They measured intent, not impact.

In one client example, a new express checkout model showed a +9% lift in conversion during pilot. But post-rollout, 40% of stores saw conversion flatline or decline. Why? Staff didn’t follow the new flow. In some stores, signage wasn’t posted. In others, associates reverted to the old rhythm. There was no mechanism in place to catch it early—the result: a six-month delay in format ROI and $2.4M in opportunity loss. Without a Retail Performance Layer, you don’t scale pilots. You scale friction.

Revenue loss hidden in micro-behavior breakdowns

Retailers often think of revenue lift in terms of product, price, and promotion. But one of the biggest levers sits inside the store in the micro-behaviors of associates at the point of transaction. Let me give you real data:

- When staff asked a customer’s name, the ATV lifted 30%

- When staff offered three product options, ATV jumped 32%

- When staff explained product benefits, spending increased by 20%

These aren’t theories. These are patterns from millions of data points. But here’s the kicker: in most retail orgs, these behaviors aren’t tracked. They aren’t coached. And they aren’t validated at the store or shift level. That means revenue is being left on the table in plain sight.

We worked with a retailer who identified that just 15 non-compliant stores were responsible for $95K in lost revenue in 90 days solely because trained behaviors weren’t being executed. Once those behaviors were coached and tracked using TruRating, the revenue came back. Fast. Most retail revenue losses don’t come from a bad strategy. They come from invisible execution slippage. And the longer you operate blind, the more expensive it gets.

Brand damage from inconsistent execution

Now let’s talk about brand trust. In a multi-location retail environment, brand equity isn’t built in a brand book; it’s built in execution consistency. And when you don’t have a performance layer, consistency dies. One store greets customers by their name. Another ignores them. One associate explains the loyalty program. Another shrugs. One location feels elevated. Another feels neglected. To the customer, there is no nuance. There’s just a decision: come back or don’t. We’ve seen this firsthand:

- Stores rated “less clean” than peers showed a 5€ drop in average spend

- Stores that failed to deliver trained service behaviors saw repeat visits decline silently – no complaints, no escalation, just attrition

- Brands that rolled out a rebrand without validating the impact saw experience scores drop by as much as 4.9%, directly eroding years of equity

Your brand is only as strong as your worst store on its worst day. And if you can’t see that breakdown happening, you can’t protect your brand.

Strategy teams flying blind and losing influence

Here’s a harsh truth most CX and Retail Strategy leaders already feel in their bones:

When your initiatives can’t be validated at the store level, when you don’t have the signal to prove your ideas are working, you lose credibility.

I’ve watched brilliant retail innovators lose budget, headcount, and influence because their initiatives “didn’t perform.” But what actually happened was this: the business had no system to confirm if those initiatives were even executed properly.

A Retail Performance Layer protects your ideas with data. It shows where the rollout worked, why it failed elsewhere, and what to do about it. It turns opinion battles into signal-led coaching. It gives Strategy, Ops, and CX a shared language around execution quality and revenue impact. Without it, every initiative feels like a bet. With it, it becomes a system.

The real cost? Operating on assumption, not evidence

If you’re making decisions without a Retail Performance Layer, you’re:

- Guessing at what’s happening in stores

- Coaching on lagging indicators

- Measuring success based on correlation, not causation

- Scaling rollouts without validation

- Losing revenue from behavior gaps no one sees

- Risking your brand with every inconsistent execution

This isn’t just inefficient. It was expensive. And it’s compounding. The performance gap is real. But it’s not permanent. It’s the result of system design.

The next section will show you what happens when you fix it and how the Retail Performance Layer transforms your operating model from reactive to responsive, from lagging to real-time, from dashboard-heavy to behavior-led. Because once you close the visibility gap, performance doesn’t just improve. It compounds.

What the retail performance layer enables

The moment you install a Retail Performance Layer, your entire operating rhythm changes. It’s not a tool you use. It’s a system you run on. Because when execution becomes visible, strategy becomes scalable. Let me walk you through exactly what this layer enables at the organizational, operational, and financial levels.

1. From “reporting experience” to performing experience

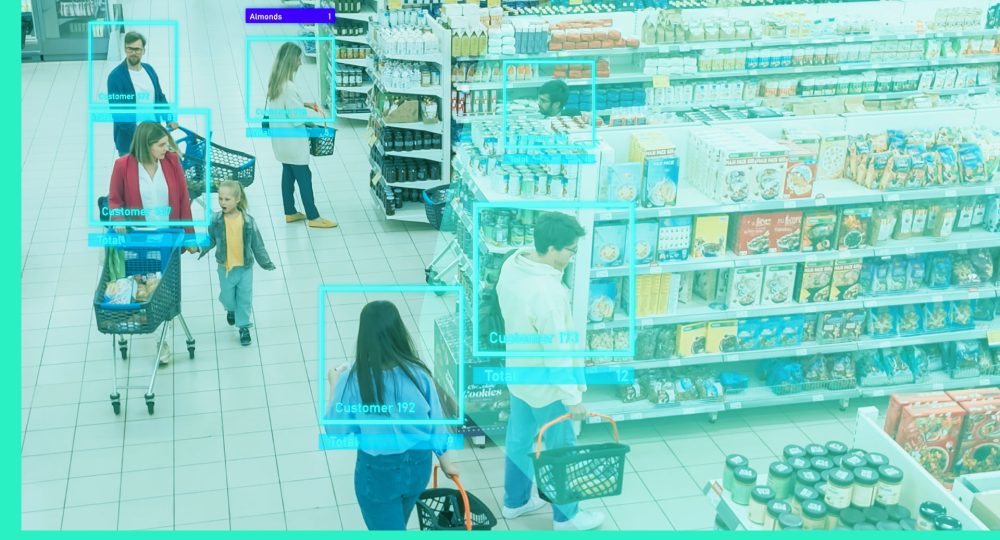

Most brands say they want to “improve the customer experience.” But what they actually do is report on it. They wait for NPS to dip, CSAT to drop, or sales to trend down and then hold a meeting to diagnose the problem. That’s not performance. That’s post-mortem. The Retail Performance Layer rewires this entire feedback loop:

- It captures micro-feedback at the point of experience: per shift, per store, per daypart.

- It connects associate behavior (e.g. greeting, suggestion, service tone) to measurable outcomes like ATV and conversion.

- It turns “experience” from a sentiment function into a performance lever.

Execution becomes visible. Friction becomes actionable. Experience becomes more performable. With this system in place, experience isn’t a dashboard anymore. It’s a daily, coachable, revenue-driving reality.

2. Coaching moves from generic to precision-based

Field and regional leaders are often forced to coach reactively:

- “Sales are down. Go figure out why.”

- “NPS dropped last month. Check in with the team.”

- “This region is underperforming. Let’s do more store visits.”

This isn’t coaching. It’s scrambling. With a Retail Performance Layer:

- You know which stores aren’t executing key behaviors and which ones are crushing them.

- You can see which dayparts are struggling, not just which stores.

- You understand why conversion dropped not just that it did.

Suddenly, coaching becomes targeted:

- “Store 143 isn’t greeting customers during the evening shift.”

- “Store 205 stopped offering add-ons after the new staffing model.”

- “Region 4 isn’t explaining loyalty benefits, and CLV is suffering.”

The result? Coaching gets faster, more effective, and directly tied to P&L outcomes. You move from anecdote to insight → from retroactive to responsive.

3. Pilots become proof machines, not hopeful bets

Today, most pilots are rolled out with incomplete instrumentation:

- We look at high-level sales trends

- We collect a few survey responses

- We wait 30, 60, 90 days to “see what happens”

The Retail Performance Layer changes this entirely. Now you can:

- Validate initiative success in the first week of launch by store, by shift, in real-time

- Compare execution across control vs. test stores

- See which parts of your format rollout are working, and where behavior breakdown is derailing results

- Understand if your failure is in design or in delivery.

This enables faster pivots, cleaner investment decisions, and bolder innovation. No more gut decisions. No more stalled pilots. No more strategy limbo. Every initiative becomes a testable hypothesis with instant feedback loops and measurable ROI.

4. Strategic initiatives get defended with data

One of the most demoralizing patterns in retail is watching high-potential initiatives get cut, not because they failed, but because they couldn’t be proven. Without a Retail Performance Layer, Strategy and CX leaders have no way to:

- Validate if trained behaviors were delivered

- Isolate where rollout adoption failed

- Defend initiatives that would have worked if they’d been executed properly

This leads to:

- Loss of credibility

- Budget reallocation

- Cross-functional turf wars

With a performance layer in place:

- Strategy teams come to meetings with execution maps, not just PowerPoint decks.

- CX leaders can say: “Here’s where the behavior broke down, and here’s what we fixed.”

- Ops leaders can show: “This is where we coached, and here’s the revenue impact.”

The conversation shifts from:

“Did it work?”

To:

“What made it work and how do we scale it?”

That’s how high-performing teams operate. And it only happens when the performance layer is live.

5. Revenue becomes repeatable because performance becomes predictable

The best-performing retailers don’t win because they hire better associates or launch better initiatives. They win because they’ve built a system to repeat what works and fix what doesn’t. That’s what this layer delivers. When associate behaviors are measured, coached, and tied to outcomes:

- You replicate top performance across the fleet

- You scale initiatives with precision

- You close the feedback-action loop in days, not quarters

- And you unlock compounding revenue improvements over time

You’re no longer chasing results. You’re building the system that produces them.

This is the shift

Let me be clear: this isn’t about replacing what you have. It’s about enabling it.

- Your POS data tells you what happened.

- Your CRM tells you who did it.

- Your VoC tells you how they felt.

But only the Retail Performance Layer tells you whether it was executed and whether it worked. That’s the difference between managing a business by explanation… and running a business by performance.

In the next article, I’ll walk through how the Retail Performance Layer transforms retail from the inside out — from a top-down command model to a closed-loop performance system built for speed, adaptability, and frontline precision.