While it would be nice to say it’s been a long time since retail was met with a singularly dominant challenge, the global cost-of-living crisis has picked up the reins from where COVID-19 left off.

With a complex set of factors pushing up prices and impacting customer spending power – retailers have had to pivot once again, to figure out the most effective way to deliver to a new set of customer needs, while continuing to keep an eye on ever tight margins.

At TruRating, we are constantly measuring and analyzing overall consumer trends across our unique cross-section of retailers and the latest of those finding can be found in our latest Consumer Insights Report – The Inflation Edition.

Over the next 3-4 weeks, we will be publishing sections of that report in their entirety, sharing fresh data to help you consider your own strategic imperatives and needs.

With data from over 170,000 consumers and insights from a team of retail experts and independent voices, there’s lots for you to dig into. But don’t just take our word for it, as Nicole Leinbach-Rehyle, founder of Retail Minded, kindly put it:

This Inflation Report from TruRating helps to bring clarity to consumer mindset and realistic inflation challenges, with identifying goals to help alleviate some of these frustrations along the way.

Check back in over the coming weeks for weekly drops, or if you can’t quite wait that long, click the banner to download the report in full today.

Why Inflation Doesn’t Impact Everyone the Same Way?

The Data:

The Story:

It can be tempting to see the impacts of inflation as all-encompassing, but data collected by TruRating shows that many of the key inflationary impacts are not being felt equally by consumers across all life stages.

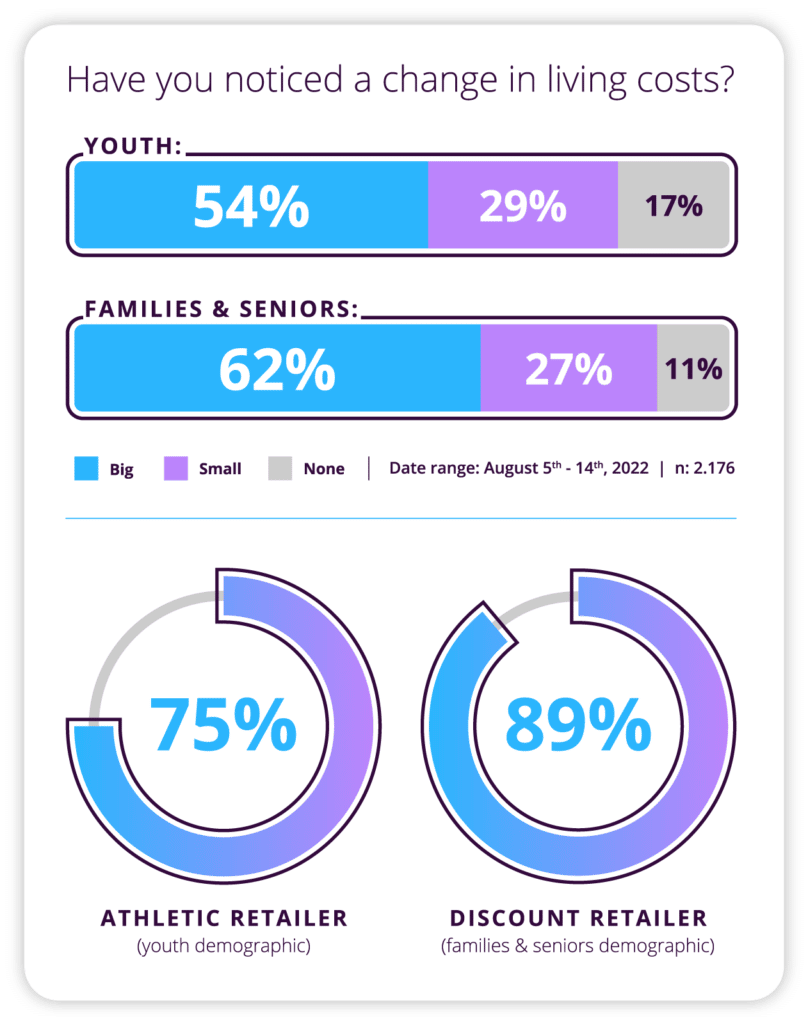

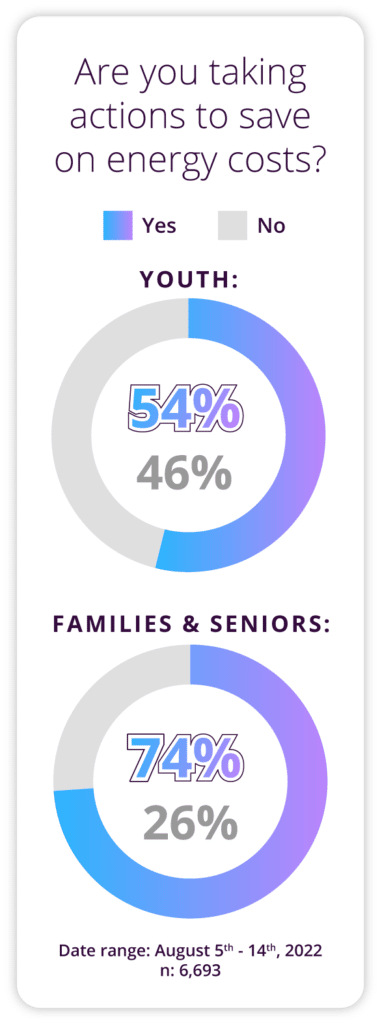

In a survey of over 6,000 consumers in August ’22 – 81% respondents said they had noticed a change in living costs, with 68% of those consumers identifying the change as significant.

Broken down to a more granular level, it becomes clear that the brunt of the burden is not being felt equally.

When we split the difference across two retailers with notably different demographics (an athletic brand serving a typically under-30 market vs. a discount brand serving families and seniors), a 14-point swing emerges, with 89% of older consumers answering yes compared to 75% of youth.

The emerging picture may not be surprising – that younger consumers are not as immediately impacted by the rise in food and energy costs as families/seniors is logical – but it raises an important point for retail at large:

The impact of inflation on shopping habits and a consumer’s likelihood to shop differently is going to depend to some degree on the target consumer group for that retailer.

While Gen Z may report a smaller impact, it does not mean that they are the group with the strongest spending power. As Baby Boomers continue to proportionately report a stronger sense of financial security – upon examination, the importance of not viewing your customer base as a single homogenous group quickly becomes apparent.

Rather than looking at inflation in a broad sense, you need to spend time seriously considering how inflation is impacting the specific demographics you serve and ask yourself an important question:

What actions can I take to best serve the needs of my specific customer base to help them through this difficult time?

The data tells us that trying to apply a one-size fits all solution, is not likely to provide the best results.

Key Takeaways:

- Inflation doesn’t treat people equally

- Understand the pain points of your specific demographic and actively show what you’re doing to help them

- Wherever possible – do this at the store and regional level

Retailer Tip:

Wherever possible you should be measuring customer sentiment at the store level to enable comparisons across your regional demographic segments. Showing that you understand your shoppers’ concerns is essential to building long-term loyalty – especially in trying times. Questions for consideration:

- Does your product range and price point match the needs of your core audience right now?

- Are you delivering targeted and granular messaging to your audience to show you’re listening?

- Are you measuring and responding to localized needs in real time?

Influencer View:

Retailers often make the mistake of assuming Gen Z is the demographic with the strongest purchasing power. That’s not the case: Baby Boomers have more wallet share than any other generation.

The reason? Inflation at every level: housing, gas, food, apparel, student loans… and the list goes on. The youngest independent demographic may never know the financial freedom of their predecessors, which may help to explain their rebellious nature.

Jasmine Glasheen, Content Marketing Manager, Surefront, Writer at the Robin Report and Retail Wire