Retail is in the middle of a data reset. Retail data can no longer be a backwards-looking summary of what sold; it must be a forward-looking system for what to do next. As Forbes recently argued, legacy models built on historic POS and blanket messaging are failing a consumer-first, tech-enabled marketplace, and leaders need to pair confidence with foresight.

“Legacy models built on backward-looking sales data, rigid inventory systems, and mass-market messaging no longer meet the needs of a consumer-first, tech-enabled marketplace.”

Gary Drenik, Forbes

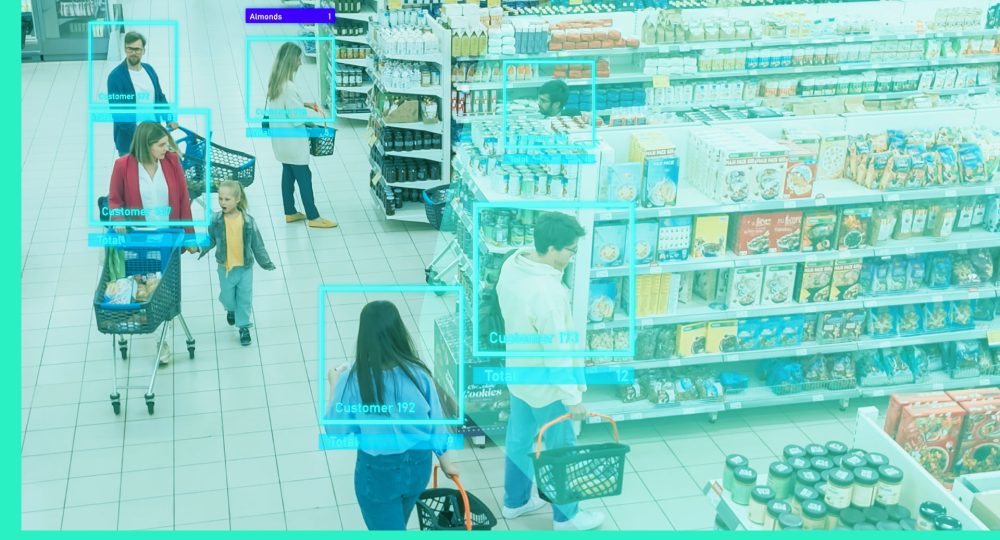

Artificial intelligence is accelerating that shift. By analysing millions of micro-signals, from shopper sentiment to staff behaviour, AI in retail transforms static data into living intelligence. It enables retail leaders to see what’s happening in real time, predict what’s coming next, and prescribe actions that improve conversion, ATV, and loyalty before performance slips.

This article explores how data is transforming retail, from defining what retail data truly means, to the evolution of retail data analytics and big data in retail, through to how retail leaders can use AI to analyse retail data and improve data quality for stronger performance, consistency and customer connection across every store and shift.

What is retail data

Retail data is the story of your retail business told through numbers, signals, and behaviors. It captures every transaction, customer interaction, staff action, and operational decision within your ecosystem. Retail sales data, retail customer data, and retailing data together form the foundation for understanding both performance and potential.

Modern retailers now collect data far beyond receipts and inventory counts. Retail data capture includes everything from dwell time and queue lengths to click paths, sentiment scores, and staff engagement levels. Each of these touchpoints feeds into retail data analysis models that reveal how customers move, decide, and spend.

For retail leaders, this isn’t academic, it’s operational. By aligning in-store performance metrics with customer experience data, brands gain visibility into what’s driving (or breaking) conversion. Real-time access to this information fuels faster interventions, smarter staffing, and performance consistency across stores and shifts.

How is data changing retail

The rise of retail data analytics is transforming retail from reactive management to proactive orchestration. Where leaders once relied on quarterly reports, they now demand continuous signal, visibility into every store, every shift, and every interaction.

A recent article from Retail Tech Innovation Hub captured the shift succinctly: “Data has emerged as the backbone of strategic retail decisions.” Retailers are no longer segmenting customers by demographics alone; they’re integrating omnichannel data integration, behavioral analytics in retail, and real-time retail reporting into one unified ecosystem.

The operational impact

- Omnichannel integration means operations, e-commerce, and marketing share a single truth. When store layouts, promotions, or digital offers change, their impact can be measured across every touchpoint.

- Behavioral analytics in retail replaces assumptions with pattern recognition, surfacing the link between staff engagement, dwell time, and conversion.

- Retail AI brings automation and foresight, identifying anomalies before they appear in sales reports.

For field and operations leaders, this convergence delivers retail operations intelligence, the clarity on where friction lives and how to remove it before it costs revenue.

How has data analytics evolved in the retail industry

Retail analytics has evolved from static reports to living ecosystems. Early systems focused on “what happened.” Today’s retail data analytics asks “what’s happening now, and what should we do next?”

Academic studies published by SAGE Journals and IJRCAIT 2025 chart this progression from descriptive to prescriptive models. Retailers have shifted from viewing analytics as reporting to embedding it within execution.

“The broad consensus among interviewees is that the retail analytics currently in use are mostly basic and backward-looking… Risk aversion (“high price tags, but no clear gains”) and inertia (“thus far we have managed without”) hinder the adoption of retail analytics.”

Robert P. Rooderkerk, Nicole DeHoratius & Andrés Musalem, The past, present, and future of retail analytics, Sage Journals, June 2020

“The progression from descriptive to prescriptive analytics represents an advancement toward increasingly sophisticated decision-making capabilities, allowing businesses to not only understand historical performance but also anticipate future trends and implement proactive strategies.”

Dheeraj Kumar Bansal, The Power of Retail Data Analytics, March 2025, IJRCAIT

The four stages of retail analytics

- Descriptive – summarising retail sales and operations results (traffic, revenue, ATV).

- Diagnostic – explaining why results changed (identifying which stores, shifts, or staff behaviours influenced performance).

- Predictive – forecasting outcomes by combining historical and real-time retail reporting.

- Prescriptive – delivering recommended actions, automated staffing changes, targeted coaching, or promotional pivots.

Retail leaders are now demanding analytics that doesn’t just describe success but actively drives it. This is where data-driven retail strategy meets execution, models that link sentiment, spend, and staff behaviour to measurable ROI.

How is big data used in retail

Big data in retail combines massive, varied, and fast-moving datasets (transactions, sensors, social signals, weather trends, and economic indicators), into actionable insight. The result is better forecasting, tighter inventory, and sharper pricing decisions.

Practical applications

- Dynamic pricing and promotion optimization – algorithms use competitive and behavioural data to refine offers daily.

- Inventory and logistics optimization – predictive models anticipate demand spikes and prevent out-of-stock events.

- Fraud and shrink prevention – AI detects irregular patterns in POS and refund data.

- Improving in-store performance – by combining transaction data and behavioural insights, teams can identify interactions that drive revenue and implement them across all locations and shifts.

Big data analytics in retail

Big data analytics in retail is the discipline that transforms overwhelming data volumes into strategic foresight. It’s where mathematics meets merchandising.

Leading retailers can now apply retail analytics data and AI to connect cause and effect, like how a greeting affects ATV, how a layout change impacts dwell time, or how staffing mix influences conversion.

The four Vs of big data applied to retail

- Volume – billions of transactions, millions of behavioural events.

- Variety – structured POS feeds, semi-structured loyalty data, and unstructured customer comments.

- Velocity – data streamed and analysed in real time for instant decision-making.

- Veracity – data accuracy and integrity enabling trustworthy conclusions.

The key to execution

Advanced retail data analysis platforms like TruRating can link emotion, behaviour, and spend. AI identifies which associate interactions correlate with higher conversion, while prescriptive layers recommend the next best action. This means decisions grounded in truth, not averages. For store leaders, it’s the confidence to coach, forecast, and scale winning behaviours.

How to analyse retail sales data

Analysing retail sales data isn’t about producing charts, it’s about revealing the levers behind performance. The process connects point-of-sale insights, customer experience data, and operational behaviours in a closed feedback loop.

The six-step framework

Capture and clean

The foundation of effective retail analytics begins with robust retail data capture. Every data source (POS transactions, CRM records, feedback terminals, staffing logs, and digital touchpoints) must be connected and quality-checked. Cleaning this data to remove duplicates and anomalies ensures that what enters your system reflects the true retail reality, not digital noise.

Unify

Once collected, bring your data into a single ecosystem (like TruHub) that integrates spend, sentiment, and behaviour. When operational inputs and customer experience data live together, they reveal patterns invisible in silos. Unified data allows for true cross-channel analysis and delivers a panoramic view of both shopper intent and operational performance.

Diagnose

With an integrated dataset, the next step is to pinpoint where friction lives. Diagnose why conversion dips, where ATV declines, or when satisfaction scores fall. Use store execution analytics and point-of-sale insights to uncover root causes (whether that’s staffing coverage, layout issues, or inconsistent associate behaviour). Diagnosis turns data into direction.

Forecast

Apply predictive analytics to anticipate outcomes before they happen such as which stores are likely to underperform next week, which behaviours drive upsell, or where demand surges will strain operations. Predictive models give leaders the confidence to plan proactively, shifting from “what happened” to “what’s about to happen.”

Prescribe

Prescriptive analytics translates patterns into recommendations such has who to coach, what to adjust, where to deploy support. AI-generated guidance, such as that provided by TruRating’s A, enables field teams and store managers to make high-impact decisions based on verified truth, not gut feel.

Operationalize

Finally, close the loop. Embed insight directly into your daily rhythm of business whether that’s coaching, planning, and reporting. Link data-driven recommendations to field execution through performance tracking and real-time feedback loops. When insights fuel frontline action, retail data analysis stops being a reporting function and becomes the heartbeat of operational performance.

Real-time AI powered analysis

When store execution analytics expose friction, long lines, low greeting scores, weak add-on rates, leaders can respond before sales slip. Combined with real-time retail reporting, analysis becomes a management system, not a monthly review.

With TruRating, each transaction becomes a feedback moment. Shoppers share sentiment at checkout; AI correlates it with spend and staff behaviour. That connection gives retailers proof of what’s working and where to act next.

How to improve retail data quality

Every retailer knows that great insights depend on great data, but few appreciate how much retail data quality determines performance outcomes. In an age of AI-driven decision-making, even the most advanced model is only as reliable as the information that feeds it. Incomplete, inconsistent, or lagging data doesn’t just skew analytics; it undermines confidence across every level of the organisation.

High-quality data is the foundation of effective retail analytics. It enables leaders to see what’s really happening in stores rather than relying on assumptions or anecdotes. Quality begins with retail data capture, the ability to gather accurate, real-time information from every transaction, every shopper, and every shift. This completeness eliminates sampling bias and ensures that analytics reflect the full operational picture, not a selective slice of customers or time periods.

Accuracy and timeliness are equally critical. A weekly report is too late. Real-time retail reporting allows field teams to act in the moment, spotting when checkout experiences start to slip or when service behaviours decline before those issues affect conversion or loyalty. The faster your feedback loop, the greater your ability to prevent performance erosion.

Consistency and standardisation also play a major role. Metrics such as conversion rate or greeting compliance must be defined the same way across stores and channels. Without that alignment, benchmarking becomes impossible and operational improvement stalls. The most advanced retail data analysis frameworks are those that create a shared language for performance, one that every stakeholder, from store managers to executives, can trust.

Equally important is ensuring verifiability and relevance. Data should always be traceable back to its source, giving decision-makers the confidence to act without second-guessing its credibility. And not all data deserves equal attention. High-quality retail data analytics focuses on what truly drives outcomes, behaviours and metrics linked to revenue, consistency, and customer experience.

How TruRating improves data reliability

This is where TruRating provides a clear competitive edge. Most retail analytics and CX tools rely on small, delayed, or skewed samples. TruRating captures real-time, verified feedback from nearly every shopper and every transaction, creating a statistically significant dataset that updates hourly. By unifying sentiment, spend, and operational behaviour, TruRating helps teams detect friction, validate initiatives, and quantify ROI, all from one trusted source of truth.

In short, improving retail data quality isn’t a technical project, it’s a performance strategy. By building accuracy, timeliness, and verification into your data foundation, you will not only see more clearly, you’ll act more decisively. With data you can trust, every store becomes a learning lab, every transaction a signal, and every decision a measurable step toward better performance.

Useful resources

- Retail pricing optimization

- Retail market segmentation

- Retail customer journey

- Retail conversion analysis

- Store operations guide