Margins are under pressure. Even as U.S. retail trade surpasses $7.4 trillion in value, growth has never felt harder won. Rising labor costs, squeezed supply chains, and intensifying digital competition have left operators searching for control. The next five years won’t be defined by who sells more, but by who executes better. That’s why the conversation around retail performance metrics has changed.

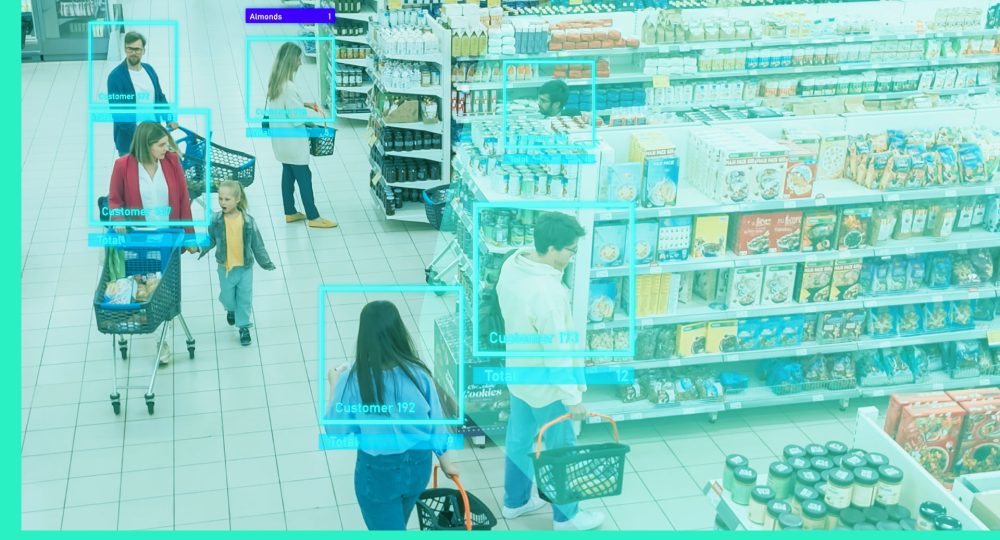

The explosion of data in retail hasn’t been about curiosity; it’s been about survival. Mordor Intelligence projects big data analytics in the retail market to triple by 2030, as brands race to truly see what’s happening in their stores. Because profitability isn’t driven by the report you read at month’s end, it’s shaped in real time, store by store and shift by shift, where the real performance metrics come to life.

For operations teams, that visibility gap is the difference between reacting to problems and preventing them. True performance control starts with a unified view of how every interaction, every behavior, and every customer moment impacts the P&L in real time.

When measured through the right lens, connecting CX metrics to conversion, spend, and loyalty, retail performance metrics give retailers the power to manage not just outcomes, but the causes behind them. This is the new language of operational performance, one where customer data doesn’t just describe the business, it drives it.

What are retail performance metrics?

Retail performance metrics are key indicators that measure how effectively a retailer converts customer experience and operational execution into measurable business results.

They include metrics like Average Transaction Value (ATV), conversion rate, customer retention, Units Per Transaction (UPT), repeat purchase rate, and basket abandonment — helping teams manage store performance metrics and behavior consistency across every shift.

By combining customer feedback, staff behavior, and operational data, these metrics allow leaders to pinpoint what’s driving results and what’s holding them back. In other words, they connect the dots between CX metrics, retail KPIs, and financial performance, turning insight into action.

The six retail performance metrics that matter most

From TruRating’s analysis of over a billion in-the-moment customer ratings, six retail performance metrics consistently predict sales growth and margin improvement. These six KPIs form the foundation of retail performance intelligence, the framework that lets operations leaders measure what truly moves the business.

1. Average Transaction Value (ATV)

What it tells you:

How effectively your staff, layout, and experience encourage customers to spend more per visit.

Why it matters:

ATV is a mirror of staff engagement and customer experience. Even a small increase, $1–$2 per transaction, can generate millions in incremental annual revenue.

How to improve:

- Use in-store feedback to identify behaviors that drive higher spend (like friendly service)

- Recognize top-performing shifts and replicate their approach

- Link ATV changes to frontline actions in real time using feedback data

2. Conversion rate

What it tells you

How effectively your stores turn browsers into buyers.

Why it matters

Conversion is a pure execution metric. A 1% increase can often deliver a greater bottom-line impact than a full-scale campaign. But most retailers don’t see conversion issues until weeks later, when the opportunity’s gone.

How to improve

- Collect feedback on purchase intent (“Did you find what you were looking for?”) to identify friction early

- React daily (if conversion dips during certain shifts, address staffing or service issues immediately)

- Track improvement against sales to close the loop between feedback and financial performance

3. Customer retention rate

What it tells you

How effectively your brand converts satisfaction into loyalty.

Why it matters

Returning customers spend 67% more than new ones, but you can’t manage loyalty with quarterly reports. Real-time retention tracking highlights where experience consistency slips.

How to improve

- Ask customers at the point of purchase, “Have you shopped with us before?”

- Use anonymized data to track repeat visits without invading privacy

- Spot declining return rates early and intervene through localized coaching

4. Basket size / Units Per Transaction (UPT)

What it tells you

Whether your team is maximising the opportunity of every interaction.

Why it matters

UPT reveals how inspired customers feel. It reflects merchandising effectiveness, team knowledge, and service quality.

How to improve

- Identify behaviors that correlate with higher basket size, such as proactive assistance

- Coach staff to recognise cues for add-on sales

- Use customer feedback to refine product placement and cross-sell strategies

5. Repeat purchase rate / Share of basket

What it tells you

How much of your customer’s total category spend you capture, and how often they return.

Why it matters

True loyalty isn’t about points; it’s about preference. Measuring share of basket helps you see how deeply your brand has embedded into everyday customer life.

How to improve

- Link repeat purchase feedback to satisfaction and ease-of-experience metrics

- Reward teams that deliver repeatable, high-quality experiences

- Identify which stores and behaviors drive the highest share of basket and replicate across the network

6. Basket abandonment rate

What it tells you

Where and why customers are walking away before completing their purchase.

Why it matters

Every abandoned basket represents lost potential margin, and a solvable problem. The reasons are often operational: out-of-stock items, long waits, or poor flow.

How to improve

- Capture in-the-moment feedback (“Was there anything that stopped you from purchasing today?”)

- Connect feedback with SKU and transaction data to identify patterns

- Empower store managers to fix friction fast, preventing lost sales before they become trends

How retail performance metrics drive profitability

Most retailers treat KPIs as lagging indicators, useful for reporting, but too slow to influence results. But when connected to real-time behavioral feedback, retail performance metrics become leading indicators that predict sales outcomes before they happen.

- A dip in “ease of checkout” scores foreshadows a drop in conversion.

- A rise in “helpful staff” scores correlates with higher ATV and UPT.

- A decline in “found what I wanted” signals early stock or display issues.

With a store-by-store, shift-by-shift view, operations team can finally act before the numbers fall, turning every feedback point into a micro-intervention that protects revenue and margin. That’s the power of connecting CX and operational data.

Benchmarking retail industry performance metrics

Setting benchmarks is where [retail performance metrics] move from insight to action. Without clear benchmarks, you can’t distinguish a good week from a great one — or spot when consistency slips across your network.

Effective benchmarking isn’t about comparing yourself to industry averages; it’s about defining what “great” looks like inside your own business and using that clarity to coach every team to reach it. Here’s how leading retailers build meaningful performance benchmarks:

1. Start with your top performers

Before looking outside your business, look within. Analyze your best-performing stores, shifts, and teams across key metrics such as conversion rate, ATV, and UPT. Your top 10% sets the gold standard, a realistic, evidence-backed starting point for internal benchmarking. Use this data to show what “great” execution already looks like inside your own four walls.

2. Adjust for context and format

No two locations are alike. A flagship store and a convenience format may have vastly different traffic profiles and conversion dynamics. Normalize your retail performance benchmarks for variables like:

- Category mix and price point

- Store size and layout

- Customer traffic type (destination vs. impulse)

This ensures your benchmarks measure execution quality, not environmental advantage.

3. Combine CX and sales data

The most effective benchmarks combine customer sentiment and operational outcomes. By linking feedback (“Was it easy to find what you needed?”) to financial KPIs (conversion, ATV), you’ll identify which customer experience signals consistently drive higher sales performance. For example, we’ve seen that on average stores with the highest “ease of checkout” feedback often achieve a 2–3% conversion lift. These insights let you benchmark both behavioral and financial performance, and coach accordingly.

4. Track store by store, shift by shift

Benchmarking should be live, not quarterly. With real-time data, retailers can track consistency across stores and shifts, spotting when and where execution fluctuates.

- Target coaching where results drop off

- See how conversion changes by time of day

- Compare staff-driven behaviors like greetings or recommendations

This level of granularity turns benchmarking into a daily management tool, not a post-quarter exercise.

5. Refresh and review

Retail performance changes fast. Benchmarks that don’t evolve quickly become irrelevant.

Review and update your retail performance metrics benchmarks quarterly to reflect seasonal patterns, promotional cycles, and process improvements. This keeps goals fresh, ensures fairness across the business, and maintains engagement among store teams.

Building a performance culture

Retailers can no longer afford to run on retrospective insight. Instead of asking, “What happened?” weeks later, the leaders of tomorrow ask, “What’s happening right now, and how do we fix it?” Building a performance-led culture means:

- Integrating feedback into the flow of work

- Measuring behaviors, not just outcomes

- Coaching with evidence, not intuition

With TruRating every feedback touchpoint becomes a live performance signal, connecting customer experience to P&L impact across every store, every shift, every day. That’s how today’s most successful retailers are rebuilding control, and protecting margin in a market that leaves no room for error.

Turning metrics into momentum

By connecting ATV, conversion, retention, UPT, repeat purchase rate, and basket abandonment to the daily rhythm of store life, retailers move from reaction to real-time performance. The result? A culture where insight fuels execution, and every store becomes a measurable engine of growth. That’s what TruRating’s delivers not another system, but a new way of seeing, and running, retail.

If you’re ready to see how real-time customer feedback can transform your retail performance metrics into measurable profit, explore our retail analytics software or book a demo with our team today.